As FAS is making sweeping changes (In the main to ensure that the power to make decisions do not rest on a single individual such as the president or the general secretary. Example: the FAS executive committee will now approve payments and expenditure.)

and

as I understand the police are about to forward their findings on FASgate or Donorgate to the AGC, I tot I’d remind readers about the governance issues involved.

The cybernuts cheering on Bill Ng ignored the governance issues surrounding the donation to AFF (which Bill initially said he didn’t know anything about) and when confronted with documentation that he knew, mumbled something and sat down.

The nuts also called the police investigations “fixing” the elections.

All this noise obscures some very important corporate governance issues.

But first a reminder of what happened.

Bill Ng started the ball rolling when he alleged that he didn’t know what his $500,000 donation (made over 11 months in 2014 and 2015) to FAS went to. There was also another “donation” for the running of Lions XII* that he claimed to be blur about.

Bill Ng’s favourite song?

Sounds like Billy started a joke that had him wife, ex-PAP MP, Zainuddin, and Winston Lee crying. It had to be a joke because how could Bill not know where the money went? He admitted this when he admitted signing the letter Winston Lee produced to rebut him. He no read isit?

Billy the Kid threw a stone at Winston Lee saying he didn’t know where his donation went to,

—————–

Later it emerged that there was documentation (signed by him) that he knew the donation was to the Asean Footie Federation for some management system for Asean clubs yet to be developed (when the donation was made in 2015) and still not developed as of now. An AFF official (Pinoy, if u must know) confirmed that ex-PAP MP, and then FAS president, Zainuddin Nordin, was the man behind the project. He remains silent.

[O]ne of the regional football associations told TODAY that it had never been asked to make donations to support the AFF’s Football Management System.

————————————————-

Bill, his wife, the ex-PAP MP and Winston Lee were arrested by the police but are out on police bail. They have also been interviewed by the police.

Here are the FAS governance issues:

— Did the senior officials of FAS alleged to have asked for donations (Then PAP MP and FAS president Zainudin Nordin and senior FAS official Winston Lee) have the authority to ask Bill Ng or his clubs (other indeed any other person or club) without the knowledge of other senior FAS officials for a huge donation to a third-party? Such a request by senior officials could be seen as intimidatory.

(Under the proposed changes all donations to the FAS above S$50,000 will be reviewed and approved by the executive committee.)

Today reported that independent candidate “James Lim was shocked to hear that the FAS had asked for donations for an external organisation.”

“I am of course taken aback that FAS would be soliciting donations for an external and even foreign organisation.

“The FAS has no business soliciting funds for AFF when they are always telling the public that it lacks the funds to implement the Strategic Plan.

“Even more shocking is that the donations were not from Bill personally but from the football clubs. Basically, money has been taken out from Singapore football, and from local football clubs.

(Under the proposed changes, FAS cannot solicit donations for foreign organisations.)

“It does not make any sense. Clubs like Hougang are receiving grants and their activities are subsidised with public funds. How can club funds be then channelled out to AFF?

— Should the said officials have told other officials that they accepted the donation from Billy the Kid for AFF?

— Should the said officials have told other officials when the FAS made its donation to the AFF?

————————————————–

“It is also shocking to hear that the FAS Council members were oblivious to such a huge amount of money being moved around.

“Winston has to come clean and reveal what was going on between Bill and FAS.”

FAS elections independent candidate James Lim told Today.

———————————–

— Was someone trying to bribe FAS officials?

— Were the appropriate accounting entries made in respect of the receipt of the funds from TBFC (five in all over 11 months) and the subsequent one-time payment to AFF? (Rumour has it they were entered as donations to FAS. The proper procedure is really complicated and should have involved opening and maintaining a separate bank account.)

— Was the donation to AFF in pursuit of a personal advantage in AFF or FIFA? Here note that Nordin publicly said last year that he wanted to become one of Asia’s delegates to FIFA. Earlier this yr, he declined to contest for a post.

TBFC governance issues

Under its constitution, can Tiong Bahru FC make the donation to the AFF?

Another governance issue not connected to the above is whether Bill Ng made full disclosure and got approval for rent to be paid to a biz controlled by his wife. If he did, the rental arrangements are halal, if not they are haram. Rumour has it that club officials told the police that while there was disclosure (and approval of) that the rent was paid to a business where Bill’s wife has an interest, there was no disclosure about how the rent paid compared to other neighbouring rents. Lawyers will have a profitable time arguing if such a disclosure was needed for disclosure to be valid.

——————————–

*The Football Association of Singapore’s (FAS) is making sweeping changes to its processes and procedures, a month after a new council was voted in. This comes in the wake of controversy in the run up to the FAS election over a S$500,000 donation by Tiong Bahru Football Club to the ASEAN Football Federation, made at the request of then-FAS president Zainudin Nordin.

A committee led by deputy president Bernard Tan on Thursday (Jun 1) announced a raft of proposed changes to the way the FAS is governed*.

http://www.channelnewsasia.com/news/sport/new-fas-council-unveils-plans-to-fix-governance-issues-8904402

**I’ll let Today tell the story

The other “donation”

TODAY also queried the FAS over Ng’s claims that he was asked to donate to the LionsXII as they had told him the budget to run the now-defunct team had “overrun”.

Ng had said that as a result, a S$200,000 sponsorship that he had secured for Hougang’s S.League season was channelled into supporting the LionsXII’s expenses for playing in the Malaysia Super League (MSL).

The FAS spokesman said: “Prior to the commencement of the LionsXII’s inaugural season, FAS sought revenues through various means including but not limited to sponsorships, donations, grants, and corporate partnerships and tie-ups…we approached corporations, partners and individuals to seek their support towards the LionsXII. Bill was among the individuals whom we had approached for referrals.

“He subsequently introduced a company which donated an amount of S$200,000 to the LionsXII’s campaign for the 2012 season.”

The spokesman also refuted Ng’s claims that they had gone over the LionsXII budget.

“The cheque was issued to FAS in November 2011 – some six weeks before the LionsXII kicked off their inaugural season,” said the spokesman. “Hence, we are baffled by claims that the budget for the LionsXII had ‘overrun’. This certainly was not the case.”

Referring to Ng’s claim that the S$200,000 for Hougang was channelled instead to the LionsXII, the spokesman said that while the FAS had asked for donations to support the LionsXII, it had always placed the S.League as a higher priority.

“While we sought to raise revenues to support the LionsXII’s inaugural season, we had also communicated to our sponsors and donors that the S.League will always be our focal point as it is the heartbeat of Singapore football,” the spokesman explained.

“This is why we ensured that we secured an increase in funding and subsidy for our clubs before we entered the partnership agreement with the Football Association of Malaysia (FAM) in 2011.”

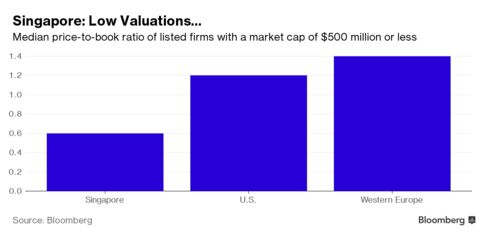

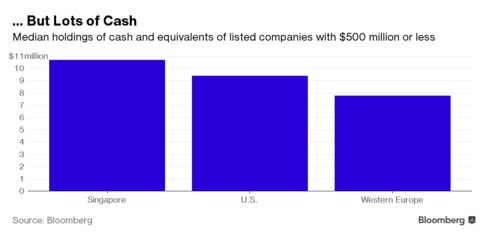

Great to see minority shareholders do something other than go to and whine to that toothless, flea ridden watchdog that is the Securities Investors Association of S’pore asking for help, or to failed presidential candidate who lost his deposit (and PAP enabler) Tan Kin Lian for help.

Great to see minority shareholders do something other than go to and whine to that toothless, flea ridden watchdog that is the Securities Investors Association of S’pore asking for help, or to failed presidential candidate who lost his deposit (and PAP enabler) Tan Kin Lian for help.