Archive for the ‘Banks’ Category

Wealth managers: The gap between the top 2

In Banks on 01/04/2024 at 6:36 amErr. maybe wrong way of looking at things?

In Banks, Financial competency, Investment banking on 21/12/2023 at 1:33 pmUBS über alles, über alles in der Welt

In Banks on 07/09/2023 at 4:16 amBuy Gupta a beer, better still make him the president

In Banks, S'pore Inc on 09/08/2023 at 6:45 amEspecially as it’s Mama time again: the turn of an Indian to be president. Their turn seems to come out most of the time, so much that we had to a reserved for Malays (whatever the word means: “Malay presidency” is “Calling a deer a horse”? and “Malay race” created by ang mohs, not the Malays).

Gupta is the real deal.

He runs a low cost regional bank.

StanChart’s

targeted 60% ratio of costs to revenue is higher than the 55% that HSBC managed last year, in adjusted terms, and the “below 40%” target of Singapore’s DBS

https://www.reuters.com/breakingviews/soaring-stanchart-still-has-lots-work-do-2023-07-28/

But he’s not just a cost-cutting banker from Citi. DBS’s, vaunted (mainly in our constructive, nation-building media but also in the int’l business media), digital services are very good. The only problem from my perspective (I recently updated my ancient POSB passbook account into its digibank) is that the digital offerings are prone to “Oops, something went wrong. Try again later”. I try again a few minutes later and there are no problems. OCBC’s and UOB’s digital banks are BS, or so I’m told.)

And from the perspective of millionaire PAP minister’ perspective, he’s a slave driver.

“it’s not because [he] want[s] people to work all the time” … “It’s just that I believe that work is a part of life.”

Constructive nation-building social media

He might just agree to be president.

DBS CEO Piyush Gupta disposes of 100,000 DBS shares at over $34 apiece

…

Following the sale, Gupta is deemed to be interested in 2.19 million shares in DBS which are held under a trust arrangement.

https://www.theedgesingapore.com/news/insider-moves/dbs-ceo-piyush-gupta-disposes-100000-dbs-shares-over-34-apiece

It’ll be good to have a president who was already filthy rich. Not like Nathan or Hali who needed their salaries to get filthy rich. LOL.

And the PAP can tell FTs that we love you guys so much that we make an FT president. Then maybe the FT will stop KPKBing that S’pore is not FT friendly. It’s not friendly to White Foreign Trash (they love to trash S’pore because they have to pay the rents from their own pockets) who are pretending to be FTs.

Have a good National Day.

Why OCBC service sucks

In Banks on 05/07/2023 at 2:08 pmToday, I read

Oversea-Chinese Banking Corporation (OCBC) unveiled on July 3 its branding and strategic refresh, which includes a target to deliver an incremental $3 billion in cumulative revenue between 2023 and 2025.

https://www.theedgesingapore.com/capital/brokers-calls/analysts-await-details-ocbcs-3-bil-incremental-revenue-goal-expected-1hfy2023

Well I was right that OCBC was trying to squeeze blood from a stone (OCBC service sucks: cost cutting at work) doing what the MBA text books say: cutting costs is the fastest and easy way to increase revenues.

Related post: OCBC ATM machines missing, call centre hasn’t a clue

“Blessed are the poor … for theirs is the kingdom of heaven”

In Banks, Financial competency, Investment banking on 02/07/2023 at 6:36 amAt least their financiers own the kingdom of heaven because said financiers are storing treasures on earth doing God’s work.

Ron Chernow’s 1997 collection of essays, The Death of the Banker, touched upon his earlier writings (He wrote two magisterial books on the Rothschilds and Warburgs.) and chronicled as the title says “the decline and fall of the great financial dynasties and the triumph of the small investor”.

Here’s the proof

JPMorgan and Morgan Stanley are major investment banks with big consumer divisions: Chase Bank for the former and its asset gathering/ broking business for the latter. Goldman, the 800-pound gorilla in investment banking, doesn’t. It tried to build a consumer finance division but has more or less given up after big losses upset investors and its investment bank employees.

Can local banks match this AI expertise?

In Banks on 01/07/2023 at 4:23 pmOCBC’s chatbot is rubbish. I’ve been told that DBS’s and UOB’s attempts to use AI chatbots are also rubbish.

On April 4th Jamie Dimon, JPMorgan Chase’s boss, said his bank had 600 machine-learning engineers and had put ai to work on more than 300 different internal applications.

Economist

OCBC service sucks: cost cutting at work

In Banks on 08/05/2023 at 5:13 amOCBC used to reply to emails after 5 biz days, This turned to 14 biz days, It recently took OCBC 22 biz days to reply to a simple request on whether physical security tokens are still available. It took 22 days to say “No” and that it’s all digital. 22 days?

It’s call centre is no longer 24 hours. From mid night to 7 am, it is closed for non emergency queries. Only fraud, lost card etc issues will be addressed.

And the last time I called the call centre during working hours, I couldn’t get pass its BS of a chatbot. Hence I called the call centre in the early morning. I’m also a lark.

It has also stopped Sunday banking.

So what’s happening?

It’s clear OCBC is cutting costs. But why? Going by DBS and UOB’s results last week the banks are making serious money.

Let’s see whether OCBC’s results have anything to do with its cost cutting.

Why Credit Suisse had to be rescued

In Banks on 19/04/2023 at 12:00 pmIn the run up to in the run up to the March 19 emergency rescue, Vontobel analyst Andreas Venditti estimates that it \may have suffered net new outflows of 110 billion Swiss francs.

Comparison or contrast: Credit Suisse suffered net new outflows of 110 billion Swiss francs in the last quarter of 2022. That was 8% of its assets under management.

So a similar amount may have “lost” in a few days (or a couple of weeks) what it “lost” in three months.

Whatever the Swiss Finance Minister had talked of a withdrawal of above 50 billion Swiss francs just before the rescue.

The bank withdrew a “large multi-billion amount” from the country’s central bank in the weekend running up to its rescue on March 19, Swiss Finance Minister Karin Keller-Sutter said on March 25. The minister said this was needed because Credit Suisse customers had again withdrawn money. She estimated the figure to be above 50 billion Swiss francs.

https://www.reuters.com/breakingviews/rivals-can-feast-credit-suisse-client-spoils-2023-04-17/

What can go wrong with buying dollar bills for 40 cents?

In Banks on 03/04/2023 at 3:17 amPlenty.

But let’s start at the beginning. Benjamin Graham (Warren Buffett’s sifu) believed that it was possible in the stock market to buy buy dollar bills for 40 cents. They both believed in finding and investing in stocks that traded below book value.

An A-Rab bank tried this well tested (and seemingly successful) strategy and it lost 80% of its investment.

“It’s a 160-year-old brand, so how far below 30 cents on the dollar on book is it going to go?”

Ammar Alkhudairy last year. He was Saudi National Bank’s chairman

In November last year, Saudi National Bank invested CHF1.4bn ($1.5bn) in Credit Suisse to buy the bank’s stock at CHF3.82 per share. SNB became the largest shareholder owning 9.9% of CS.

However in March this year, there was a run on the bank. After agreeing (actually it was forced) to buy CS, UBS is offering CS shareholders CHF0.76 for each share.

(See how much deposits fled in 2022.)

Will another European bank need to be rescued this coming Friday?

In Banks on 27/03/2023 at 5:02 amCredit Suisse: It’s at 11

In Banks on 19/03/2023 at 3:51 amBritish is best in class, even better than Swiss

In Banks on 16/03/2023 at 11:59 amMore on DBS

In Banks, S'pore Inc, Temasek on 03/12/2022 at 2:09 pmFurther to The kind of FT turned citizen that S’pore needs, here’s more on why DBS is a favourite among ang moh investors.

And the CEO is paid peanuts compared to JP Morgan’s CEO and the CEOs of the other banks referenced in the chart. Mamas provide cheap labour.

Btw, my banking exposure here is in UOB via Haw Par: Haw Par: Rediscovered yet again

LOL: Millionaire PAP ministers are really looking after the plebs

In Banks, Economy, Financial competency, Financial planning, Investments, S'pore Inc on 07/11/2022 at 5:39 amLook at this and you’ll see that with the exception of the Chinese banks (Communism at work?) and DBS (Remember that POSB was the people’s bank?), at least $10,000 is needed for FDs. Quite a number (including OCBC and UOB) have a minimum of $20,000.

So it’s nice to know that the millionaire PAP ministers are helping the plebs to get good interest rates on fair terms via Singapore Savings Bonds.

Plebs only need to invest $500 (Same like the Commie bank, ICBC. Need $1000 at DBS) in the the Singapore Savings Bonds. The minimum one can invest in SSBs is $500 — and this can increase in multiples of $500 — but the total amount of such bonds one can hold at any one time cannot exceed $200,000. (Btw, in 2020, when the interest rate on SSB was 0.96 per annum for the first few years and S’pore was being locked down and I got very lucky, I applied for 200k and was filled. It can’t happen nowadays. The allocation is 10k nowadays. Fine by me as I don’t have $200,000 needing to find an urgent home. Btw2, I redeemed the lot in batches in 2021 and very early 2022.)

Returns on the Singapore Savings Bonds hit record highs for the second straight month, with the latest December issue offering a 10-year average return rate of 3.47 per cent. Better still, the first-year interest rate of 3.26 per cent is also the highest ever, beating the record set in the previous issue. I’ll be applying.

And there’s more:

Safe and flexible bonds for individual investors. Enjoy returns that increase over time and redeem in any month without penalty

https://www.mas.gov.sg/bonds-and-bills/Singapore-Savings-Bonds

“[W]ithout penalty”: remember that FDs can only be “broken” by foregoing the interest. But SSB only have a $2 fee when redeeming. Interest is paid up to redemption date. Pretty fair.

More at https://dollarsandsense.sg/complete-guide-buying-singapore-savings-bonds/?

Do remember that the govt is tightening money supply via SSBs and other interest-bearing securities. this to to try to keep inflation in check. There’s a reason for its generosity. But its also keeping the banks honest.

Property exposure of local banks

In Banks, Financial competency, Property, Reits, S'pore Inc on 05/11/2022 at 1:51 pmFurther to The kind of FT turned citizen that S’pore needs, I tot I’ll share this so that someone overseas can KPKB about our banks very, very large exposure to the local property sector.

DBS estimates that approximately 44%-50% of Singapore banks’ loan books are exposed to Singapore properties via residential mortgages and via lending to REITs or other private vehicles may be captured under “financial institutions, investment and holding companies”

https://www.theedgesingapore.com/capital/brokers-calls/dbs-explains-what-higher-interest-rates-spell-banks-and-developers-cdl-uol

As the PM’s Mrs made me $ (Tempting fate but thanks again Ho Ching), and I’m not one of those PAP running dogs from our constructive, nation-building media who turn on the PAP like hyenas and jackals once they no longer get paid (Another running dog turned self-appointed tribune of the HDB plebs ), I’ll just keep quiet and look at my bank statement.

I also got exposure to UOB and UOL (via Haw Par: Haw Par: Rediscovered yet again) and Reits.

I’ve never voted for the PAP. But to quote the FT minister, “I’m invested in S’pore”and that is the way I show my appreciation of what the PAP does to keep me in prosperity.

The kind of FT turned citizen that S’pore needs

In Banks, Financial competency, S'pore Inc, Temasek on 04/11/2022 at 4:03 amGupta makes DBS Great. Previous ang moh or pseudo ang mohs made it a laughing stock. CEOs Btw, he’s another Citibanker

Our other two banks are also looking good. Eat your heart out, the overseas based anti-PAP paper warrior. U should bot into them.

Which reminds me of a clueless tai tai (Tai tai’s luck runs out, heading for Woodbridge?/ Tai tai forgot this ), sold her SPH shares her elderly husband gave her when they married in the 90s, sold them and bot DBS when she panicked in 2020. She then sold DBS because she said UOB paid more in dividends (What an ass). Then sold UOB to buy SPH when it spiked from 1.20 to 1.90 last year, then sold out in panic when it weakened before it rebounded

. Her husband told her to buy back the UOB because it was cum dividend and there was 80 cents in it.

She didn’t sitting on cash. Then going into Hang Seng and Chinese techs: Tai tai keeps losing money

Private banking, the Asian way

In Banks on 18/07/2022 at 5:28 amAsian private bankers are really casino croupiers, not private bankers.

Private bankers in Singapore and Hong Kong say that their Asian desks are heavily exposed to revenue from clients trading frequently as opposed to hubs such as Switzerland where banks manage money for the rich and get a regular fee.

Much of the wealth in Asia is in the hands of self-made entrepreneurs keen to make their own bets, while in Europe, it’s held by the second and third generation who want to preserve the wealth and task private banks with managing their money. In bull markets, transaction fees are a lucrative source of income, but in market downturns, they can quickly dry up.

https://sg.finance.yahoo.com/news/ubs-citi-among-banks-hit-by-asia-rich-clients-pullback-091707913.html

Some context to Temasek’s Chinese bank holdings

In Banks, China, Media, S'pore Inc, Temasek on 17/07/2022 at 3:50 amBackgrounder: Temasek owns 2% each of China Construction Bank and Industrial Bank of China as for 31 March this year, Temasek reports.

Headline

Chinese regulators rush to tame investor panic over mortgage boycotts

Homebuyers stop paying loans on more than 200 unfinished property projects

FT article on China

Chinese banks provide these mortgages.

Will the constructive, nation-building media ever link these facts?

Temasek: Win some, lose some

In Banks, Temasek on 21/02/2022 at 6:24 amI couldn’t help but think of Temasek when I saw the first chart in an article on DBS. It owns controlling stakes in DBS and Stan Chart.

It has to thank the FT CEO of DBS (OK, OK, he’s now a citizen). The “T” stands for “Talent”. But then S’poreans deserve a break. For a long time, the “T” in FT stood for “Trash” when it came to the quality of DBS’s FT CEOs, two ang mohs and one ABC. One ang moh and the ABC came from JPMorgan. It specialised in corporate and investment banking, not consumer banking.

Gupta came from the consumer banking side of Citicorp.

Btw, if anyone is wondering about UOB’s price to book value, it’s 1.2, a shade below OCBC’s 1.3.

Want to save the planet? Don’t take a mortgage

In Banks, Corporate governance, Energy, Environment on 03/01/2021 at 5:06 amThe environmental kay pohs KPKB that banks are complicit in global warming by financing fossil fuel companies.

Interestingly, Dutch bank ABN Amro says its mortgage book causes more greenhouse gas emissions than its lending to mining or industrial companies.

Part of an on-going series that ESG investing in marketing BS.

Digital banking: Why SingTel and Grab are onto a winner

In Banks, Internet, Telecoms on 23/12/2020 at 6:34 am

The digital finance opportunity is huge. A joint survey from Alphabet-owned Google, Temasek and Bain & Company found that over a third of e-commerce consumers in the region’s top six economies only started to use online services because of the pandemic and over 90% plan to stick with their new habit. The same report forecast online payment transactions will rise 15% to $1.2 trillion by 2025, up from $620 billion in 2020.

https://www.reuters.com/article/us-singapore-banks-breakingviews/breakingviews-grab-ceo-will-step-into-2021s-tech-limelight-idUSKBN28V09K

In particular, think the opportunity to handle the remittances of FTs particularly the Indon and Pinoy maids. then the Indian FT and Bangladeshi FTs. Singtel has as associates telcos in Indon, PinoyLand and India. SingTel is oversold: go buy some. I own some shares.

(Btw, read the above link because it gives a glowing picture of the prospects for Grab. S’pore’s the cash cow for Grab after Uber surrendered.)

FYI, how FT reported the award of the digital banking licenses:

Singapore has finalised the award of digital banking licenses to four operators this month. In picking Sea, Ant Group and a consortium between Grab and Singapore Telecommunications as three of the license winners, Singapore is harnessing some of the region’s biggest tech names.

“We expect the speed of innovation of the new digital banks to strengthen Singapore’s position as a leading financial hub in the region,” said Paul Ng, financial services lead for south-east Asia at Accenture.

The move could help boost digital financial services in south-east Asia (see chart). Online lending is expected to grow fourfold between 2020 and 2025, to $92bn, while online investment assets are set to increase to $84bn from $21bn over the same period.

FT

FYI, SingTel, Hong Leong will get digital bank licences

I’m not using this Big Brother Service

In Banks, Financial competency, Financial planning on 15/12/2020 at 11:42 amS’pore residents can now view financial information from various banks in one place, with launch of new tech structure

Read more at https://www.todayonline.com/singapore/spore-residents-can-now-pool-financial-information-various-banks-one-place-launch-new-tech

The authorities on Monday launched a tech infrastructure called the Singapore Financial Data Exchange (SGFinDex). It uses SingPass — the national passcode system for e-government services — and a centrally managed online consent system that will help individuals access their financial information across different government agencies and participating financial institutions.

Deputy Prime Minister Heng Swee Keat (The guy with THE plan for his East Coast GRC which many residents didn’t care for: the PM in waiting nearly lost the GRC winning only 53.4% of the votes) said that the process to consolidate finances is often onerous. But this new underlying technology allows data from each source, which is encrypted, to be transmitted through SGFinDex without being stored, Singaporeans and foreign residents with a SingPass will be able to view their consolidated financial information.

Whatever, as I understand it, whoever is providing the user with the consolidation can see the data. This means the banks and MoneySense (A Singapore Government Agency Website) can see the consolidated numbers, if I’m correct.

I don’t see any advantage for someone like me. It’s so easy via e-banking to see how much $ I have in my various accounts with different banks. And transfer.

I also don’t want any one bank or Moneysense to see how rich I am to suka suka market to me. I assume that if it wants to, the ISD or the police can access details of all my accounts but that’s a different matter. That’s the price of living in S’pore. But I don’t have to make things any easier for millionaire ministers.

Tai tais’ guide to banks’ earnings

In Banks, Financial competency on 13/11/2020 at 10:02 amEvery tai tai and her toy boy have invested in our banks because of the yield.

But when the results come out, they don’t understand what they mean.

Here’s a cheat sheet. Look out to see if there’s

A rise or fall in net interest income

A rise or fall in fee income

A rise or fall in provisions (allowances) for loans turning bad

A higher or lower cost to income ratio. The cost to income ratio measures the level of expenses the bank incurs to its revenue.

Finally is the CEO optimistic, guarded or worried about the prospects for the bank until the next reporting

Btw, I’m wrong so far in being bearish on our local banks: Can local bank stocks fall by 37%? (cont’d) and PAP a socialist party again?/ Banks doing NS.

Related post: Weath mgt is not the treasure chest local banks think it is

PAP a socialist party again?/ Banks doing NS

In Banks, Economy, Political economy on 11/10/2020 at 6:07 amCovid-19 is making govts all over the world ditch their ideologies and becoming pragmatists .

The PAP govt is no exception: its forcing the banks (protected and cosseted by the PAP govt) to be nice to debtors:

With many borrowers expected to continue to face financial issues amid a prolonged COVID-19 pandemic, the Monetary Authority of Singapore (MAS) is extending its support measures for various groups of borrowers, including allowing those with property loans to apply to temporarily reduce their monthly instalment payments.

https://www.channelnewsasia.com/news/singapore/covid-19-mas-extends-financial-relief-measures-borrowers-13202850

Those with renovation and student loans may also opt for a longer repayment period, while small- and medium-sized enterprises (SMEs) will get to partially defer principal payments for some loans and receive customised restructuring options.

The MAS, in its media release on Monday, urged borrowers who are able to resume loan repayments in full to start doing so from January so as to avoid increasing their overall debt.

In the late 70s when I was in London, I heard a story that at a recent PAP cadre conference, the word “socialism” was removed from the PAP’s constitution. So it’s nice to see the PAP returning to its socialist roots. One Harry Lee must be spinning in his urn.

Of course all these moratoriums affect banks’ profits. There’ll be those who can pay and pay, but will ask for a delay. They can use the cash that would have gone to the banks to play the markets.

And there’ll be a day when the banks have to write off the loans that the govt is now forcing them to pretend are not in default, and extend.

But don’t worry, the PAP govt is on top of the situation. In a sign that things could deteriorate for the banks and their investors:

Financial institutions will be allowed to use their security interests in Housing and Development Board (HDB) flats as collateral for liquidity from the Monetary Authority of Singapore (MAS), as part of the Government’s plan to improve their access to funding from the central bank amid the COVID-19 crisis.

The new rule is part of the amendments to the Housing and Development Bill passed on Tuesday (Oct 6).

https://www.channelnewsasia.com/news/singapore/banks-pledge-hdb-property-loans-to-mas-credit-liquidity-13212374

Of course, Minister for National Development Desmond Lee had to say

that although banks in Singapore have healthy liquidity buffers, greater access to credit will strengthen their resilience given current economic headwinds and is a “pre-emptive measure”.

https://www.channelnewsasia.com/news/singapore/banks-pledge-hdb-property-loans-to-mas-credit-liquidity-13212374

He would have to say this wouldn’t he?

What do you think? Is the minister BSing?

Btw, when banks cut dividends further: Can local bank stocks fall by 37%? (cont’d)

OCBC ATM machines missing, call centre hasn’t a clue

In Banks on 04/10/2020 at 4:39 amSorry about yesterday’s cock up when I published “OCBC’s cock-up” but didn’t provide any text. It was an honest mistake.

Back to to story behind the headline.

Yesterday morning around 6.15am, my friend jogged to his nearest OCBC ATM machine to draw cash for his monthly expenses. The ATM machine at the Esso station was covered up. He then jogged to a 7-11 store a few hundred metres away. The ATM machine was also covered up.

There was a further OCBC ATM machine, 500m along at a 24 hr Fairprice store. But he decided it wasn’t worth the risk of jogging there and finding out that it too was shuttered.

Back home, he went online to see if OCBC had made any announcements about ATM closures in the East Coast area. He couldn’t find any.

He called the call centre and the girl was surprised when he told her about his experience as her records showed that there were supposed to be ATM machines in the locations he described.

She said the nearest available one was at Fairprice. He asked her what assurance he had that she was right given that she had no knowledge of the missing machines. She said he had a point.

He asked her to tell the bank to call him when the offices opened. He never got a call. But to be fair, she did say that it would take 48 hrs for the bank to respond because it was the weekend.

Later my friend called the Esso station and was told the ATM machine was shuttered on 1 October. So there was sufficient time for the call centre’s info to be updated.

But then since the call centre was in M’sia maybe it’s the usual case of M’sia Boleh aka M’sian inefficiency?

Minister Iswaran doesn’t know that 10 yrs ago DBS’s chairman aspired to have “homegrown” CEO

In Banks, S'pore Inc on 09/09/2020 at 5:37 amOr has that aspiration been discarded?

Let me explain my queries.

Minister Iswaran recently said: “I am not sure what you mean by “homegrown”.

He said this in the debate over the issue of foreign talent here on Friday (Sept 4). Minister for Communications and Information S Iswaran chiding (sneering?) NCMP Leong Mun Wai for his comments on DBS Bank not having a “homegrown” CEO.

Mr Leong (Progress Singapore Party) had said in his maiden speech in Parliament on Tuesday that he is “deeply disappointed” that DBS still has not appointed a homegrown CEO, 22 years after former JP Morgan executive John Olds became first FT CEO in 1998. He was a disaster and he was followed by a series of FT ang moh (including one honorary ang moh: American born Chinese) clowns until Gupta came along: He made DBS respectable again. And he’s making it great.

(Mr Piyush Gupta, who is the bank’s CEO, was born in India and became a Singapore citizen in 2009, the same year he was appointed CEO.)

I’d like to remind the minister that shortly after one Peter Seah became chairman of DBS in 2010 (He still is), he said that DBS had good locals that could one day be CEOs. He unfortunately, in my opinion, cited a lady who later became an NMP: in that postion she showed why she can’t even be a CEO of even an SME.

Seriously, it seemed then that having a local as CEO was seen as an aspiration of the chairman and the bank.

Going by the minister’s chiding (Or is it a sneer?), it’s no longer an aspiration of the chairman and bank since DBS already has a new citizen as CEO?

What do you think?

Btw, Iswaran is a true blue S’porean and according to his Wikipedia entry “a Tamil Brahmin“. Tharman’s and Shahmugam’s Wikipedia entries juz say they are ethnic Tamils.

Many yrs in the ST newsroom, a newbie FT ethnic Indian from Nepal is alleged to have asked a veteran ethnic local Indian colleague, “I’m a high caste Hindu, what caste are you?”. She’s now one of S’pore’s prominent Wokes and ang moh tua kees.

Wonder if Iswaran did the same to Tharman and Shahmugam when they met?

Can local bank stocks fall by 37%? (cont’d)

In Banks, Economy, Reits on 05/08/2020 at 4:10 amFurther to Can local bank stocks fall by 37%? And other investment tales, here’s another good reason to think that bank stocks can really tank.

In the UK, where banks are usually generous dividend payers, after the authorities told banks to stop paying dividends until next yr, the banks decided to compete on seeing who could %wise have the largest loan loss provisions. HSBC (where I’ve owned shares since the early 1980s) won this show of macho, increasing provisions by a third more than expected. Shares fell by another 4% on Monday and 3% yesterday. The share price is near its 1996 lows and have already fallen below the late noughties low.

What I’m predicting is that our banks will be increasing their loan provisions beyond analysts’ expectations. They will be reporting their latest results soon.

So it’s possible that our banks’ share prices can fall by 37%.

Last chance to sell as shares recovered their Monday losses yesterday.

Good luck, yield chasers who tot banks were safe. Why not try industrial reits? They’ve held up pretty well. Buy the second liners (not the GLCs) so that I can smile when I look at their prices.

Can local bank stocks fall by 37%? And other investment tales

In Banks, Financial competency on 03/08/2020 at 6:29 amLast Thurday, DBS fell by 3.09%, UOB by 3.15% and OCBC 3.82% because following the Monetary Authority of S’pore’s July 29 announcement on capping Singapore banks’ FY20 dividends at 60% of their FY19 levels.

Analysts from DBS Group Research, OCBC Investment Research, and CGS-CIMB Research have maintained their “hold” or “neutral” recommendations for the shares of DBS Bank, UOB and OCBC.

But in the past, these analysts (and many others, to be fair) said that the banks’ share prices are underpinned (among other things, to be fair) by their dividend yields of around 6%.

So shouldn’t the dividend yields now adjust to reflect this?

Well if they do, share prices can fall a lot: up to 36-37% from their last traded prices.

Remember you heard this first here. LOL.

Btw, I have an economic interest in UOB via Haw Par:

Btw2, I missed a bullet. I was thinking of buying OCBC shares. Glad I didn’t but btw3 I’m into two dogs that I had tot had bottomed out: SingTel and SPH.

Btw4, I think I’ll stick to my industrial reits, sub-$1 stocks, and penny stocks. Less risky.

Btw5, hopefully if the bank stocks collapse, they bring the market down and I can get some penny stocks at decent prices. Juz grin and bear on SPH and SingTel: no averaging down. Juz collect dividend lor.

China humiliates India twice in June

In Banks, China, India on 19/06/2020 at 4:31 amYou would have read in the Indian and international media (China slaps Modi, will Modi just sit down and shut up?) about how the Indian army got beaten up.

But it’s a lot worse for India. It’s the second Chinese humiliation in June. I reported this in early June

OK, OK, I exaggerate, China only rescues Jaguar Land Rover (JLR), a British car maker, part of Tata Motors since 2008.

The Bank of China, Industrial and Commercial Bank of China, Bank of Communications, China Construction Bank (all of which are state-owned) and Shanghai Pudong Development Bank gave a £560m credit line to JLR after the UK govt told JLR to bugger off because its bonds are rated as junk. Like other car makers, JLR is short of cash because of Covid-19 has disrupted the supply and demand for cars.

:Covid-19: China rescues India’s Tata.

The reason why Indian banks couldn’t lend the money to Jaguar Land Rover is because of a very slow-burning crisis in the Indian financial system. A long history of bad lending decisions and poor governance has led to serious problems in India’s banks, shadow banks and mutual funds.

The result? Indian banks had no money to help out Tata Motors. Chinese banks were more than willing to lend, doing their patriotic duty of showing up India’s pretensions of being China’s equal.

Time for Modi to do something rather than bully defenceless Muslims and jobless workers.

Stand up for India, Modi.

Proud ethnic Indians overseas are getting tired of being sneered at by racist ethnic Chinese: “We’re far superior to Indians and what happened on Monday proved it.”

But cows are likely to fly before Modi does anything to make overseas ethnic Indians proud again.

Time to Make India Great Again?

Covid-19: China rescues India’s Tata

In Banks, China, India on 08/06/2020 at 4:02 amOK, OK, I exaggerate, China only rescues Jaguar Land Rover (JLR), a British car maker, part of Tata Motors since 2008.

The Bank of China, Industrial and Commercial Bank of China, Bank of Communications, China Construction Bank (all of which are state-owned) and Shanghai Pudong Development Bank gave a £560m credit line to JLR after the UK govt told JLR to bugger off because its bonds are rated as junk. Like other car makers, JLR is short of cash because of Covid-19 has disrupted the supply and demand for cars.

Where were the Indian banks when Tata needed them? Chinese banks lend to a trophy asset of Tata, India’s pride and joy, when India and China are rowing: While India was fighting Covid-19, China invaded.

What’s in it for China? Telling Indians that its banks are better than that of India’s, most of which are according to the analysts are in dire need of capital because of bad debts to Indian tycoons.

JLR is Britain’s largest automotive manufacturer and designs, manufactures and sells some of the world’s best-known premium cars (the iconic Land Rovers), but sells most junk Jaguars.

Tata Motors got sold a dog. Sad. But then the Tata group very anglophile: British junk is the best.

Hin Leong: Must be DBS and OCBC again

In Banks, Energy on 18/05/2020 at 4:56 amDabbling in oil-related lending yet again and losing money. (Previous fiasco: see end of article.)

Honourable exception is UOB where I got economic interest via Haw Par: Haw Par: Rediscovered yet again. Btw, during the recent market falls, the Wee family co was buying Haw Par shares.

Local banks’ exposure (ex UOB) not as tiny as what our constructive, nation-buildng media try to picture it by emphasising HSBC’s exposure.

Here’s the truth, thanks to Seedly

S$411 million (US$290 million) owed to DBS — 0.11% of DBS’ loan book

S$354 million (US$250 million) owed to OCBC — 0.12% of OCBC’s loan book

S$209.7 million (US$148 million) owed to UOB — 0.05% of UOB’s loan book

S$850.7 million (US$600 million) owed to HSBC — 0.0005% of of HSBC’s loan book

https://blog.seedly.sg/hin-leong-scandal/?fbclid=IwAR39LRL8OX_kZLbm1qj201_2GuDl9R2A4zgLF-etv4L-y2BhOyNii1FNnZE

Good work Seedly. Go to the above cited link for a great blow-to-blow account of what happened to Hin Leong.

Here’s another schematic showing OCBC’s and DBS’s in exposure in perspective to other banks. Interestingly, only one US bank has a tiny exposure, and its not Citi.

The last time oil prices tanked a few yrs ago, DBS and OCBC were caught swimming naked with big exposures to the offshore marine sector (Think Swiber).

DBS: Some things never change, bad service is a given

In Banks, S'pore Inc on 15/05/2020 at 8:07 amEarlier this week, I posted Weath mgt is not the treasure chest local banks think it is.

Well its over a week since the DBS call centre told me that someone would call me in response to a query that the person couldn’t answer. I have an existing POSB account and I was thinking of moving all of my mum’s interbank giro’s instructions (She’s in her 90s and I didn’t want to find that everything was cut off once she moves on and her banks find out) to this account. I had some queries that the DBC call centre couldn’t answer.

Later, I happened to call Starhub and the call centre gal told me what to do to change payment instructions. I had also by then realised that I would have to go down in person to a POSB branch to apply for a debit card. (Not DBS’s/ POSB’s fault, as I never had a POSB debit card. Given the pandemic, I didn’t feel like risking getting the virus juz to get a debit card so that I can then do e-banking.)

Anyway, I’m half way thru the process of converting all my mum’s standing instructions to my HSBC account.

Will DBS ever call me?

In the 1980s, I closed my DBS current account after really bad service. In recent yrs the ang moh media and our constructive, nation-building media have been lauding DBS’s growth into a “super regional” bank by using technology to propel its growth.

It’s share price must surely reflect its success in e-banking.

But for me, service still sucks.

Weath mgt is not the treasure chest local banks think it is

In Banks on 12/05/2020 at 6:41 amOur local banks are trying to be big in weath mgt here and in their other regional markets. Of course given their dominant positions in S’pore, it’s a no brainer to do it here. Or so they think.

They should think of what happened in Oz to the dominant Oz banks who went into wealth mgt thinking they could screw or rip the faces off the sheep.

These Oz banks are now simplifying their product range and organisational structure with the main four groups — CBA, ANZ Bank, Westpac and National Australia Bank — all retreating from wealth management, a sector where some of the most egregious misconduct cases occurred.

As to the regional aspirations. Nothing to add from what I wrote yrs ago.

OCBC paid such a high price for the Asian private banking business of ING and why DBS and UOB are trying harder to build up decent private banking businesses, despite repeatedly failing to do so in the past.

S’pore banks: Is private banking the future?

Related post:Banks can lose money on private banking business

And what applies to private banking, also applies to wealth mgt for us plebs. And remember the retreat of the Oz banks.

HSBC is Hongkong Bank (Cont’d)/ Hongkies got balls

In Banks, Corporate governance, Hong Kong on 14/04/2020 at 5:01 amI didn’t realise until I read the FT that Hong Kong retail investors, “own roughly a third of the shares”. Like them, I’m upset, that the British authorities forced it and other major UK banks to cancel dividends.

What annoys is that the shares have traded ex dividend and those of us who take our dividends in scrip form had already been informed of the numbers of shares we were getting.

But Honkies are doing more than KPKBing

The decision of HSBC to suspend its dividend payments has sparked a backlash among investors in Hong Kong, its biggest market. Along with other big British banks, hsbc suspended shareholder payouts after the Bank of England leant on them to do so, but a group of investors in Hong Kong has banded together to try to force an extraordinary general meeting on the matter.

Economist

They took on China and now HSBC. Hongkies got balls.

Related post: Why HSBC is really Hongkong Bank

Interesting ideas from Germany and US to protecting borrowing home owners and their lenders

In Banks, Financial competency, Financial planning, Property on 22/02/2020 at 2:38 pmRecently I wrote in TRE cybernuts and central bank singing from the same song sheet that our central bank is worried that

Singapore property market faces risks from unsold units, uncertain economy: MAS

Here’s what the Germans do to protect banks and borrowers

German mortgage-lenders embrace an unusual appraisal technique. When assessing the value of a house, they rarely refer to market price; instead they consider “mortgage-lending value”, an assessment of the probable price of a house over the economic cycle. A report from the Bank for International Settlements, a club of central banks, suggests that by discounting short-term price fluctuations, this valuation technique can stop bubbles from forming. Lenders in America once embraced the technique, points out Ed Pinto of the American Enterprise Institute, a think-tank, yet after the second world war it fell out of fashion.

Meanwhile in America

Safe Rate, based in Chicago, offers a new type of mortgage. When local house prices decline, so do borrowers’ monthly mortgage repayments. The benefit for the borrowers is that they save money and are less likely to default. The advantage for investors is that, by preventing foreclosures, more mortgages will be kept going and it is less likely that house prices across a region will spiral downwards.

Waz the point of local banks’ going digital?

In Banks, Internet on 04/02/2020 at 2:36 pmBS in action and wasted productivity.

“Experts” are asking how the new digital banks can really differentiate themselves. They say market is already well served by big financial institutions who have good digital banking services.

These “experts” don’t know how the local banks work. Yes they have good digital services but only on paper.

I’ll highlight a major failing of the big three local banks and HSBC. (They, StanChart and MayBank dominate retail banking. I don’t know much about the last two’s digital banking services. But i don’t think they willing to go against the grain.)

The fixed deposit (FD) rates that HSBC and the three local banks are offering online are BS. If you use their online systems to put money into FD accounts, you get screwed.

They whisper to customers over the counter that you really must go down to the branch to get the best FD rates. It’s peanuts but the online rates are atom-sized peanuts.

Worse, when want to renew, still got to go down to the branch to get the best rates. WTF.

As I recently asked a bank customer service officer “Why go digital, when the customer has to come down to the branch to get the so-called best rate? Buggeration at work”

She juz giggled.

Whatever, try avoid using FD deposits. Best: Using yr CPF OA as a savings account. But as can withdraw only once a year, so FD deposits still needed.

(Amended to reflect change if CPF rules after I last took out money before my birthday last year. 45 Feb 2020 at 1.30 pm)

Of course one can buy dividend paying shares, or Reits and hope the prices don’t collapse.

Making yr money work harder for u

In Banks, Financial competency on 18/12/2019 at 5:16 amWhat with GST going up another 2 points soon, us coupon clippers got to find the difference so that we can continue eating Stilton, French butter, suckling pig etc.

The dividend yields on DBS, OCBC and UOB are 4%+. And so are the forecasted yields. Now for those of us who have second tier S-Reits up to our eyeballs, this is “peanuts”.

But instead of putting money into fixed deposits, maybe KS S’poreans should think of buying the shares of one of the local banks: remembering that you may not get back the amount invested if things go wrong. Equity premium risk leh.

And do remember: Using yr CPF OA as a savings account.

Why buy bank shares? Because PAP govt is friend of banks or so it seems: Why I hold Hongkong Bank and UOB shares

HSBC: West not tua kee

In Banks, China, Hong Kong, India on 31/10/2019 at 4:29 amIn fact ang moh sui jee.

HSBC recently came up with a worse than expected set of results. Despite a US China trade war (HSBC is world’s largest trade financier and China’s the wotld’s workshop) and HK riots, its Asian businesses performed in line with analysts’ expectations.

Ang moh countries under-performed as usual but disappointed the already low expectations

HSBC’s cost-to-income ratio is 104% in Europe, compared with 43% in Asia, where it generates nearly 90% of its profits. The bank makes only a quarter of its lending in Britain, yet the country generates 35% of its non-performing loans … Its $98bn of risk-weighted assets allocated to America produce only $527m in annual profit.

Ang mohs are expensive, useless deadbeats. The only Asian country in HSBC’s empire like ang moh land is Ah Neh Land.

Related posts

HK: Why HSBC can still smile: Money withdrawn from mainland banks are deposited into Hang Seng Bank. Majority-owned by HSBC but has its own listing and distinct identity and brand. Google up images of its branches. More on Hang Seng Bank: HSBC, Superman and another Cina superhero.

Why HSBC is really Hongkong Bank

HK: Why HSBC can still smile

In Banks, Hong Kong on 22/10/2019 at 5:05 pmIn Why HSBC is really Hongkong Bank

I wrote

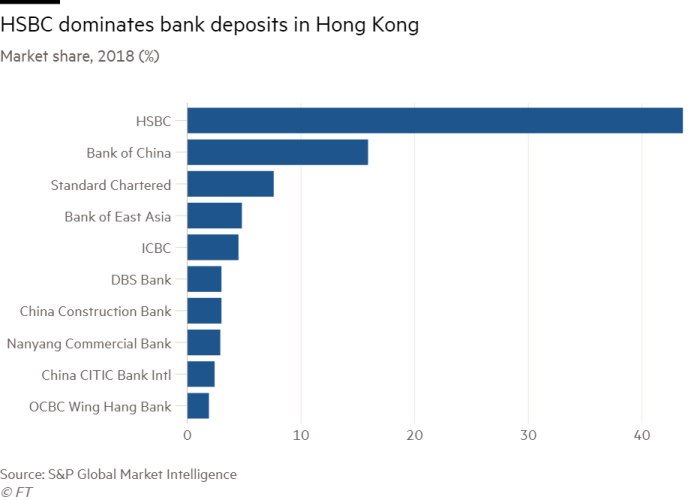

I’m very surprised that BoC is a distant second in terms of deposits. I tot the gap was much narrower. And this was in 2018. I’m sure BoC lost a lot of deposits.

Well since then, there have been reports that BoC branches have been targeted by the rioters, as have the branches of other mainland controlled banks.

Sure HSBC is suffering because HK is its biggest and most profitable market

But the attacks and withdrawals from the Chinese banks must bring a smile to the quai lows at Hongkong Bank.

IRAS help line betterest

In Banks, Internet, Public Administration on 03/10/2019 at 5:26 pmRecently, I had to reorganise my HSBC bank accounts: closing one, and opening another with access to e-trading.

One of the things that resulted from the reorganisation was that I had to move the giro deductions for property tax to the new account. I decided instead to move it to an existing historical account in OCBC because because it and DBS were the only two banks that allowed me to do set up a giro account with IRAS via the internet. Yes UOB does not have this privilege (Wonder why? After all Wong Kum Seng is the chairman and the previous chairman was Temasek’s president. Its finech and e-banking is rubbish?), and so using HSBC entailed downloading a form (I don’t have a printer), filling it in, and posting it.

But there were a few things I needed first to clarify with the IRAS. I was pretty depressed about calling the IRAS up because of my really bad experiences with SingPass: SingPass sucks, really sucks (Cont’d) and SingPass technical support versus that of OCBC and HSBC

But I was very pleasantly surprised. Getting thru to an officer was a breeze (Getting to talk to a bank officer via the help line is so bothersome).

And the officer was really helpfully, even telling me things I hadn’t tot about.

Fyi, I’m told Li Hongyi is responsible for SingPass. If so

Li Hongyi got a lot to do before he is PM material. And grandpa and GCT didn’t set the bar very high for Hongyi’s pa did they?

Why HSBC is really Hongkong Bank

In Banks, Emerging markets, Hong Kong on 23/08/2019 at 11:40 amYesterday, HSBC took out advertisements, in five Cantonese-language newspapers. The bank said it was deeply concerned about the recent events and “condemned violence of any kind”, saying the rule of law is vital to maintaining Hong Kong’s status as a financial centre. “That is why we fully support the ambition to resolve the present situation peacefully.”

Why is it so concerned?

These three charts show why HSBC is really Hongkong Bank (It once used this name), and the last two charts also show that it’s the people’s bank in HK. All of which explains the ads and what an HSBC spokesman said recently: “We respect that our employees have their own personal views on political and social matters. Our priorities are the safety of our employees and supporting our customers.”

A 34-year-old HSBC bank employee said the bank had not officially sanctioned the strike on Monday but some managers had told staff verbally they would not be penalised for not coming to work.

FT

Interesting, relevant, little known facts about HK’s general strike

Remember that HSBC includes the Hang Seng Bank which has a lot of branches serving the people: the takeover of Hang Seng Bank was the start of HSBC becoming a global bank: HSBC, Superman and another Cina superhero. I’m very surprised that BoC is a distant second in terms of deposits. I tot the gap was much narrower. And this was in 2018. I’m sure BoC lost a lot of deposits.

Wh

HoHoHo: StanChart CEO kanna lick ass/ Temasek acts

In Banks, Corporate governance, Emerging markets, Temasek on 21/07/2019 at 4:41 amAfter further upsetting shareholders unhappy with his pay, by calling them”immature and unhelpful” (HoHoHo: StanChart CEO upset that investors angry about his salary), he issued a statement saying

I regret my inability to get my points across in the manner I intended and certainly meant no disrespect to our shareholders.

He explained that when talking to FT

about leadership I urged a conversation about the pressing questions of inequality, fairness of executive compensation and the role of corporations. The focus on a single component of pay, which in the case of Standard Chartered had no effect on total compensation, has crowded out this important debate.

Ha, Ha, Ha. Pull the other leg, it’s got bells on it.

The FT helps him out

He bristles at the suggestion that he is overpaid. Although he was Britain’s second-highest-paid bank CEO last year — his total package was almost £6m — he earns a fraction of what he did at JPMorgan. Critics counter that StanChart’s share price has fallen by about 20 per cent since he took over in 2015, versus double-digit gains for competitors HSBC and DBS.

(With friends like the FT who needs enemies?)

The very latest from the FT is that Temasek has told the directors of StanChart to sort the matter out in a way that wins support from the bank’s other large shareholders. FT reports the bank is considering asking its chief executive to take a pay cut.

What? He’ll resign given that he’s paid peanuts (albeit his performance amounts to monkeying around). But maybe that’s what Temasek wants?

Related post on the mess StanChart is in: HoHoHo: StanChart accused of more crimes

HoHoHo: StanChart accused of more crimes

In Banks, Corporate governance, Emerging markets, Temasek on 20/07/2019 at 6:43 amThe good news is that the accusation comes not from the US marshals that have been making life difficult for the go-to bank for Iran’s activities to by-pass US sanctions, but by whistleblowers in a civil law suit.

StanChart has been accused of handling U$56.8bn of dollars in allegedly illegal transactions with Iran-connected entities in a civil suit. They allege StanChart cleared far more transactions in violation of Iran sanctions between 2009 and 2014 than the US government used as the basis for fines paid by the bank in April (This prediction came true: HoHoHo: StanChart gets into more trouble).

The new claim filed on Thursday piles further legal woes on the emerging markets bank which has been hit with a series of penalties by US law enforcement and regulators in the past seven years for lax financial controls and for handling transactions for companies in Iran and other sanctioned countries.

FT

Quiet so. and CEO still KPKBing about his pay: HoHoHo: StanChart CEO upset that investors angry about his salary?

Weekend reading:

HohoHo: StanChart’s strategic plans are sounding like our restructuring plans

HoHoHo: StanChart CEO upset that investors angry about his salary

In Banks, Corporate governance, Emerging markets, Temasek on 18/07/2019 at 4:09 amThe FT had a piece on Tuesday in which Bill Winters, the CEO of StanChart, criticised shareholders after almost 40% of them voted against the bank’s pay policy at its annual meeting in May: Temasek stood by him. They were upset about the pension contributions made to Mr Winters.

“Picking on individual pension arrangements . . . and suggesting that there is some big issue there is immature and unhelpful,” the CEO of StanChart KPKBed.

On Wednesday the FT quoted shareholders hitting back.

Five top-20 shareholders (not Temasek with 16% though) in the bank told the FT that they were unimpressed by Mr Winters’ decision to attack shareholders. One big asset manager described the chief executive as “tin eared”.

Another large shareholder said: “As an immature investor, I’m going to not make any rash comments, but look forward to the fallout coming.”

Whatever, underperforming CEO (HoHoHo: Time for StanChart’s CEO to go? and HO Ho Ho: What Temasek forgot when it bot into StanChart) it seems is behaving like millionaire PAP ministers when it comes to money: StanChart mgt think they like PAP ministers isit? and HoHoHo: StanChart CEO learning from our ministers.

Sounds like what Secret Squirrel told me is true: Temasek has warned him his end is nigh if he can’t improve the bank’s performance soon. So he’s frustrated and angry and hits out unthinkingly.

This outburst can’t help his relations with Temasek as there are now many comments online on FT website pointing out Temasek’s failure to get rid of him.

To be fair to him, his pay is “peanuts”. He got a lot more as a JPMorgan senior executive.

Banking the African way

In Africa, Banks on 14/07/2019 at 2:06 pmReal Wild West cowboy banking (Beats HSBC: Doing God’s Work by being the drug cartels’ favourite bank and HSBC: great customer & shareholder service.pales

Burundi’s state prosecutor has accused one of the country’s main commercial banks of letting money flow to militia groups in eastern Democratic Republic of Congo, thereby threatening the security of the east African country.

Interbank Burundi denied the accusations in court in the capital, Bujumbura, on Wednesday.

Last week in Bujumbura, two officials of Trust Merchant Bank of the nearby city of Uvira in DR Congo were arrested with $1.5m (£1.2m) in cash from Interbank Burundi on their way to Uvira.

The prosecution said it was investigating reports that the cash was being channelled to finance militia groups in eastern DR Congo.

Interbank Burundi denied the allegations, saying it was playing a routine, intermediary role to facilitate money transfers between Trust Merchant Bank Kinshasa and its Uvira branch.

The court in Bujumbura is to give its verdict in 10 days.

BBC report

SingTel, Hong Leong will get digital bank licences

In Banks, S'pore Inc, Telecoms on 01/07/2019 at 5:06 amMAS to issue up to five new digital bank licences: SM Tharman

Constructive, nation building media

It’s a nap that two of the licences will go to SingTel (or a SingTel jv) and Hong Leong Group

SingTel or a jv led by it will get one of the two digital full bank licences, which will allow licensees to provide a wide range of financial services and take deposits from retail customers. The focus of a SingTel bank will be regional remittances via its regional network of telcos. Think of all the Peenoy and Indon maids who remit money via remittance firms.

Grab or Go-Jek could decide to try to cut a deal with SingTel, rather than apply for a virtual bank licence themselves because they can bring to the party a regional presence via their apps etc. But SingTel may be too greedy to do a jv. I suspect the authorities will make SingTel tie up with Go-Jek or Grab. But the other co will not be left out in the cold (see below) because I think the authorities want competition here between the two and because Temasek has stakes in both: Temasek, GIC got this right in our backyard. Related post: Offered money, Grab it

Hong Leong group will get one of the up to three digital wholesale bank licences, which will allow licensees “to serve SMEs (small and medium-sized enterprises) and other non-retail segments”. Hong Leong Finance is a de facto SME bank though people like Inderjit Singh and Jack Sim are not happy with the way it does biz, and are forever KPKBing for really cheap financing for SME owners, even though it’s a fact that SME owners often divert biz loans to buy property.

Grab, Go-Jek and Razor will try for the other virtual bank licence, though I think they’ll have to find a S’porean partner because

Companies headquartered in Singapore and controlled by Singaporeans will be able to apply for digital full bank licences.

Foreign companies who wish to apply must form a joint venture with a Singapore company, the authority added. The joint venture must meet the headquarter and control requirements. Digital wholesale bank licences are open to all companies.

I’m sure they will try to get M1 owned by Keppel and SPH to partner one of them.

But as I said for Grab and Go-Jek working with SingTel could be a better bet if SingTel is not too greedy. The other could then tie up with M1.

As to Razer? Razer? Who the f@#! is Razer?

Why I hold Hongkong Bank and UOB shares

In Banks, Financial competency on 27/06/2019 at 4:38 amOK, OK, I only have an economic interest in UOB via shares in Haw Par. The underlying reasons for investing in Haw Par haven’t changed since 2011: Haw Par: Rediscovered yet again. More recent analysis: https://www.fool.sg/2019/02/28/haw-par-declares-bumper-special-dividend-for-their-full-year-2018-earnings/

As a result of the high cash balance and also to celebrate Haw Par’s 50th anniversary, the group has declared a bumper special dividend of S$0.85 per share in addition to its final dividend of S$0.15 per share. The sum of its final and special dividend amounts to S$1 per share, and if we include its interim dividend of S$0.15 per share, the full-year dividend would be S$1.15 per share. At Haw Par’s last done share price of S$12.39 on 27 February 2019, that represents a trailing dividend yield of 9.3%.

(Bear in mind that the huge dividend yield is due to “special” dividend. It’s normal dividend yield is between 3-4%. FYI, UOB has a 4%+ yield.)

Btw, OCBC and DBS recommending UOB. So do ang moh brokers.

Back to why I own HSBC and Haw Par shares: S’pore and HK are very kind to banks:

SingPass technical support versus that of OCBC and HSBC

In Banks, Internet on 11/06/2019 at 7:00 amBut first, HSBC is boosting the headcount of its wealth management team in Asia. The focus is here, where the banks says it will launch new digital initiatives this year.

The bank should ensure that staff are trained in PR as well in the technical details. I have e-banking accounts with OCBC and HSBC. The OCBC staff are not that good in technical support as the HSBC staff, who really know their stuff. But when it comes to telling client about the features, the OCBC staff are really great.

As for SingPass support, what can I say? I had another bad experience yesterday. Gal hadn’t a clue. Worse gal never called back despite promising to call back later in the day: still waiting. Btw, a tech mole helped me solve the problem I had, a problem caused by the SingPass system. I’ll provide details later this week.

But for now, I can use SingPass: no thanks to the staff or the system.

Related post: SingPass sucks, really sucks (Cont’d)

GIC bitten once, still not shy?

In Banks, GIC on 05/06/2019 at 10:47 amTaz GIC when it comes to buying Swiss Banks.

It bot a 3% stake in Swiss private bank Julius Baer, in what FT says @is in a vote of confidence for the bank after months of lacklustre performance”.

FT went on

GIC was previously a large shareholder in UBS. Having purchased hybrid debt instruments in the bank during the financial crisis, the fund became its largest shareholder after the holding converted to equity. The fund sold off the bulk of its stake two years ago, however, after the investment failed to perform.

Related posts

Iran today, China tomorrow: What US will do

In Banks, China on 27/05/2019 at 9:42 amThe US Department of Justice (even under wimp Obama) has gone after foreign banks for trading with countries like Iran: the global financial system being dominated by the US dollar. A French bank was crucified, StanChart bashed on the head etc because they did biz with countries the US didn’t like.

Financial system can be used against China too.

And if sells its US treasury notes, it hurts itself. Also what can it buy with the US$ it holds in lieu of notes? Japan and Germany will make China pay to hold their debt: already at negative yields. And if it sells the US$ it holds for euros etc, how is it going to fund its Belt and Road projects using those currencies.

DBS: Money talks BS walks

In Banks on 06/05/2019 at 3:46 amDBS Visa Debit card, which gives 5 per cent cash back when you tap for your purchases. You can get up to S$50 back a month as long as you spend at least S$400 a month, which can be easy here even with the bank’s limit of S$200 a tap.

https://www.todayonline.com/singapore/benefits-tagged-debit-cards-can-help-savings

Meanwhile OCBC believes its customers only shop at FairPrice, Popular and Cheers

get a 4 per cent discount at NTUC FairPrice supermarket and a 3 per cent discount at FairPrice online, as well as 3 per cent off at Popular bookstores or Cheers convenience stores.

UOB’s debit card is nothing to write home about.

StanChart: More unhappiness

In Banks, Corporate governance, Emerging markets, Temasek on 30/04/2019 at 4:31 amAnother influential shareholder advisory influencer, Institutional Shareholder Services, has recommended that investors vote against Standard Chartered’s pay policy at its annual meeting next month and described the bank’s method of calculating executive pension allowances as “disingenuous”.

ISS said that investors should cast their ballot against the emerging-markets bank in a binding vote on its pay policy on May 8 because of a change in how it calculates executive pension allowances.

Glass Lewis published a similar recommendation earlier.

Together,Glass Lewis and ISS usually influence over roughly a quarter of votes in any listco: a sizeable number. But Temasek is relaxed about the bank’s pay policy: StanChart mgt think they like PAP ministers isit?

StanChart mgt think they like PAP ministers isit?

In Banks, Corporate governance, Temasek on 15/04/2019 at 4:21 amGlass Lewis, a proxy advisory group, recommended that shareholders vote against the company’s pay policy at the coming AGM. The influential advisory group said it was concerned by the bank’s decision to change its methodology for calculating the pensions of executives including chief Bill Winters.

However the FT had reported earlier that Temasek doesn’t have an issue with Stanchart on the matter: HoHoHo: StanChart CEO learning from our ministers.

How to? Given our ministers earn so much but their performance is only so-so. Their only credible claim of success is that things have not regressed to the standards of one-party states like Cuba, N Korea, California, New York and Venezuela. Hey what about Vietnam and China? They also one-party states.

Make S’pore Great Again. Summon Harry, Dr Goh, the other Chinese Old Guards and Ahmad Ibrahim. The Indians, other Malays and Eurasians in the Old Guard can remain in their graves.

HoHoHo: Rogue bank kanna fined again

In Banks, Emerging markets, Temasek on 09/04/2019 at 6:27 am(Updated on 10 April at 5am: StanChart will pay US and UK authourities US$1.1bn to settle charges that it violated sanctions and ignored red flags about its customers: more than expected. It’s deferred prosecution deal with the US marshals extended until 2021. Ho Ho Ho.)

Standard Chartered is bracing itself for a bumper fine this week that could total hundreds of millions of pounds as it settles US charges over Iranian sanctions violations.

The London-headquartered but Asia-focused bank is expected to draw a line under a long-running investigation into sanctions busting by Wednesday when a six-year deferred prosecution agreement (DPA) with US authorities is set to expire.

DPAs allow firms to settle charges with state authorities without facing criminal prosecution. The companies must agree to specified conditions, which can include a fine and their conduct being monitored for a set period.

Related posts:

StanChart: Yet more problems for “rogue bank”

HO Ho Ho: What Temasek forgot when it bot into StanChart

HoHoHo: Time for StanChart’s CEO to go?

HoHoHo: StanChart’s CEO is worse than our paper generals

HoHoHo: StanChart CEO learning from our ministers

In Banks, Corporate governance, Emerging markets, Temasek on 22/03/2019 at 10:58 amHe also gets a free pass from Temasek.

FT reports that StanChart is facing an investor rebellion over its chief executive’s pay after the bank changed how it calculated his pension in a way that falls foul of UK corporate governance guidelines. This comes as executives at the UK’s largest listed banks are being subjected to rising pressure to reduce their pension payments so that they are in line with the majority of staff.

StanChart’s CEO will receive a pension allowance of £474,000, which is the highest of any chief executive of a large UK-listed bank.

But unlike UK investors, Temasek, StanChart’s biggest shareholder, a person close it said it did not share other investors’ concerns on pay at the bank.

Related post: HoHoHo: Time for StanChart’s CEO to go?

Comprehensive list of articles on what went wrong with this investment: HoHoHo: Temasek’s “rogue bank” kanna caught again

China’s emerging fintech giant

In Banks, China, Insurance, Internet, Investment banking on 21/03/2019 at 1:53 pmBut first, why China is great again: Chinese insurer Ping An once had HSBC as a large shareholder but is now the largest shareholder in HSBC.

Besides insurance, it’s into banking, securities broking, asset management and has a trust biz.

In recent years Ping An has invested heavily in the development of new technologies including artificial intelligence, facial recognition and cloud computing.

So it’s becoming a tech co, like Goldman Sachs (At least that is what ex-CEO claimed that is what Goldie is).

Tun not happy with MayBank

In Banks, Malaysia on 20/03/2019 at 4:37 amNo not because it financed Tuaspring helping S’pore give him the finger over water.

But because Maybank (“May” is short form of “Malayan”) is saying that M’sians are buying our banks because they are of better quality, and pay higher dividends, thanks to the M$ being up s**t creek.

Maybank Kim Eng is keeping “positive” on Singapore’s banking sector while noting significant interest among Malaysian investors in Singapore banks from a flight-to-quality angle, and for their high dividend yields as the SGD appreciates.

This comes post a meeting with 15 Malaysian investors from a mix of long-only, hedge and private-banking funds to discuss Singapore banks and Maybank’s stock calls on them – for which the research house says was very little pushback on its top picks DBS and UOB, both rated “buy” with the respective target prices of $29.56 and $29.71.

OCBC, on the other hand, has a “hold” rating and price target of $10.73.

Note of all three banks, OCBC has the most exposure to M’sia because of its extensive branch network in Malaya and its life insurance biz via Great Eastern M’sia, 100% owned by Great Eastern.

Secret behind DBS’s fintech success

In Banks on 14/03/2019 at 1:28 pmDBS is now the ang moh investors’ favourite SE Asian bank. It has a successful digital strategy that has the both the buy and sides saying “Buy”. UOB or OCBC can’t match DBS’s fintech skills.

Well the dirty secret is that there are almost no S’poreans in its much deservedly vaunted fintech team. They are mostly FTs from achar land or PRC land. Locals (top young STEM grads from NUS or NTU) feel lonely and that they are working in Bangalore, Mumbai, Beijing or Shanghai.

Interesting that Peenoys not smart enough to work there. but the Peenoy HR personnel team in DBS are working on getting their fellow Peenoys employed there.

Hyflux on investor losses: “Not our fault, banksters at work”

In Accounting, Banks, Financial competency on 27/02/2019 at 5:08 amOK, OK, Hyflux never said this. But going by what it has said publicly (See below), one can reasonable infer that this is the message it’s trying to imply: the motor-cycle riding Ms Lum, other investors, employees etc are suffering because Hyflux’s banksters were scared of losing their money, making a run at Hyflux, trying to squeeze money from Hyflux’s hard assets.

Let me explain.

According to Hyflux everything was fine financially in March when it’s auditors chanted everything was halal, not haram.

When KPMG issued an unqualified opinion on the full year results for the Hyflux Group in March 2018, there were no events or conditions that individually or collectively, cast significant doubt on the going concern assumption as at the balance sheet date of 31 December 2017, or at the audit report date of 22 March 2018.

Must be joking, right?

Auditors are supposed to assess continual use of going concern assumptions over the next 12 months as per the Singapore Auditing Standards SSA 570. With the (bankruptcy) protection filing date being two months after KPMG’s sign-off date, what are the material variances which have not been contemplated resulting in this failed assessment?

BT quoting an investor who lost $ in Hyflux

—————————————————————————————————-

Then according to Hyflux, everything went wrong when in May, there was a run on Hyflux by its banksters. Because of its bad (and unexpected?) Q12018 results announced on 9 May: “certain financiers expressed concerns over their ability to continue with existing credit exposures to the group.”* They tot halal Hyflux had transmuted into haram Hyflux.

Reminds me of the joke which Hyflux should have quoted:

A Banker Lends You His Umbrella When It’s Sunny and Wants It Back When It Rains

(Often attributed to Mark Twain)

But to be fair to its banks, did Hyflux tell its banks post December 2017 results, that everything was oh so fine financially, so that the 1Q 2018 results came as a big surprise to its lenders?

To be continued.

But I’ll leave you with what a top banking lawyer** once told other lawyers about bankers

Just remember this: if bankers were as smart as you, you would starve to death

(Henry Harfield addressing a meeting of lawyers in 1974)

Remember MayBank (the non-recourse lender) according to Hyflux really believed that Tuaspring was worth more than $1bn.

When Hyflux was first awarded the Tuaspring project in 2011, based on the financial model which modeled the cashflow projections from the project, the power plant was expected to generate profits from day one. This financial model was audited by an external financial model auditor and furnished to the offtaker. In 2013 when Tuaspring was able to secure a non-recourse project financing loan, the lender commissioned an independent market study of the project which arrived at similar conclusions supporting the book value of approximately SGD1.4 billion.

Related post: Hyflux fiasco shows why “book value” is BS

———————————————-

*This is what Hyflux said:

The operating losses of Tuaspring drove Hyflux to record its first full year of loss in 2017. When losses were also reported in its first quarter 2018 results released on 9 May 2018, certain financiers expressed concerns over their ability to continue with existing credit exposures to the group. This, coupled with the uncertainty of Tuaspring divestment or entry of a strategic investor, raised a significant spectre of an upcoming liquidity crunch. Accordingly, subsequent to discussions with its legal and financial advisors, the Hyflux Board was advised to proactively take steps to make an application for a moratorium order, which is where events stand today. At that point in time, the company was in full compliance with its financial covenants and was not in default of any financing facility.

https://www.hyflux.com/wp-content/uploads/2019/02/Hyflux-responses-to-SIAS-letter.pdf

**From NYT’s obituary

Mr. Harfield spent his entire career at the New York law firm of Shearman & Sterling, where he helped develop the legal and regulatory framework for the international banking business after World War II. He represented the firm’s lead bank client, Citibank.

Many of the issues he worked on were esoteric, but important. He developed the legal basis for negotiable certificates of deposits, creating a legal way for commercial banks to pay interest on deposits. Citibank introduced certificates of deposit as a product in 1961.

HSBC: another view

In Banks, China, Emerging markets, Hong Kong on 24/02/2019 at 5:06 amFurther to HSBC: Looking vulnerable, the view from an institutional broker, here’s another view from the Investors Chronicle, a respected retail investor magazine.

It says “Buy: HSBC”

HSBC’s progress is encouraging. That bodes well for the maintenance of its dividend, which was last cut in 2009.

showing the retail emphasis on sustainable dividend. (Think: Hyflux is warning of investing in high dividend yield stocks.)

It says HSBC’s Asia pivot makes it a natural victim of US-China trade rows. Chairman Mark Tucker blamed market weakness during the fourth quarter for lower-than-expected revenue for 2018: must have financed large share purchases on margin.

Combined with a 6 per cent rise in adjusted operating expenses as the lender seeks to expand across the northern China and Pearl Delta areas, this resulted in negative adjusted “jaws” – the difference between the rates of change in revenue and costs — of 1.2 per cent.

In its global banking and markets business, economic uncertainty and reduced primary issuance led to lower adjusted rates and credit revenue. But this was partially offset by stronger demand for securities services and global cash management liquidity.

Retail banking and wealth management were much stronger, posting an 8 per cent rise in net operating income. That business benefited from a 9 per cent rise in lending and improved deposit margins due to rising interest rates.

But mortgage lending grew in the UK and Hong Kong, although margins shrank.

Higher lending and adverse foreign exchange movements across business lines also resulted in an increase in adjusted risk-weighted assets, which reduced the common equity tier one ratio to 14 per cent from 14.5 per cent in the prior year. However, the return on tangible equity improved by 1.8 percentage points to 8.6 per cent, with management reiterating its target to grow that figure to over 11 per cent by 2020.

Expected credit losses were slightly higher than loan impairment charges in 2017: blame Brexit and trade rows. Credit quality in the UK will get worse.

Analysts at Shore Capital expect adjusted net tangible assets of 732 cents (US) a share at the December 2019 year-end, up from 701 cents at the same time in the previous year.

HSBC: Looking vulnerable

In Banks, China, Emerging markets, Hong Kong on 23/02/2019 at 4:49 amBecause investors are likely to be disappointed: slower revenue growth, no share-buy back and dividend yield could go up (share price falls).

JPMorgan Cazenove, a leading UK broker, downgraded HSBC to “underweight” from “neutral” with a 620p target on the back of the bank’s full-year results on Tuesday. Among the broker’s concerns was a rise in funding costs as Hibor — a measure of lending costs between banks in Hong Kong — underperforms Libor, the equivalent UK rate.

Although we rate HSBC’s management highly and view the group on the right strategic path long term, we believe that revenue growth pressures (partly as a result of the changed outlook for US rate hikes, a widening Libor-Hibor gap and macro uncertainty) alongside cost investment needs could weigh on the [return on tangible equity] outlook for longer than we previously thought.”

With HSBC unlikely to deliver an 11% on tangible equity by 2020, its premium valuation of 1.2 times book value looked exposed, JPMorgan said. It added that while HSBC no longer had a capital surplus, but investors continued to expect a share buyback this year.

The dividend of 51 cents (US) should remain stable over the medium term but the yield of 6% (in line with other UK banks) might move higher (i.e. because share price falls) because of the the uncertainties faced,

HoHoHo: Temasek’s “rogue bank” kanna caught again

In Banks, Emerging markets, Temasek on 02/02/2019 at 9:07 amStandard Chartered pays $40m fine after forex rigging probe

US authorities claim UK traders tried to manipulate emerging markets currencies

FT Headline

More on its problems:

“Criminal” activities

StanChart: Yet more problems for “rogue bank”

HoHoHo: Ho’s rogue bank woes (Cont’d)

Ho Ho Ho: StanChart still in jail

Incompetent mgt

HohoHo: StanChart’s strategic plans are sounding like our restructuring plans

HoHoHo: StanChart’s CEO is worse than our paper generals

No home market

HO Ho Ho: What Temasek forgot when it bot into StanChart (Got share price chart since Temasek bot into it. Got very sick looking at it)

But the gd news is that FT reported recently that Temasek had very recently told the mgt that it was not happy. I wrote last October HoHoHo: Time for StanChart’s CEO to go?. Shumeone in Temasek reads me? Ho Ho Ho

Have a prosperous and Happy Chinese New Year. To ensure this vote wisely. And certainly not for Mad Dog, Lim Tean and Meng Seng . But do think of voting for good SDP teams if they are better than the PAPpies.

HO Ho Ho: What Temasek forgot when it bot into StanChart

In Banks, Emerging markets, Hong Kong, Temasek on 22/01/2019 at 4:43 amThere’s an FT report that Temasek is putting pressure on StanChart to shape up. It’s tired of being reminded that under the current CEO, the share price has fallen 40%. Worse, share price is roughly at half of Temasek’s entry point 13 years ago.

Temasek forgot when it bot into StanChart that StanChart did not and still does not have have a major, thriving, prosperous market that it dominates.

Although it’s smaller than the supertanker of HSBC, it doesn’t have the engine of Hong Kong that HSBC does, so it’s taking every bit as long, if not longer, to reform. But we’re still very supportive.

(Hugh Young, head of Asia Pacific at Aberdeen Standard Investments, which holds a stake of about 5 per cent in the bank talking to the FT)

It also does not a client like the Lis.

The story of how two Chinese gentlemen made Hongkong Bank great is told in HSBC, Superman and another Cina superhero.

HoHoHo: Ho’s rogue bank woes (Cont’d)

In Banks, Emerging markets, Temasek on 14/01/2019 at 10:00 amGST sure to go up leh. Jialat for PAP govt and us.

Ex-Standard Chartered banker prepares to plead guilty in Iran case

Emerging markets lender under investigation for alleged sanctions breachesFT headline

Goes on

Although no formal charges have been brought, an internal Standard Chartered investigation found at least one of the bankers under scrutiny was receiving secret kickback payments, one of the people said.