Archive for the ‘Malaysia’ Category

Mighty S$

In Currencies, Indonesia, Malaysia, Philippines, Thailand, Vietnam on 28/10/2023 at 5:27 amAsean & the Ugly S’porean Tourist

In Indonesia, Malaysia, S'pore Inc, Thailand, Tourism on 12/07/2023 at 6:09 am

Or is it the “Ethic Chinese Ugly Tourist?

Wonder if the use of yellow for S’pore’s “crescent and stars” instead of white is to hint that S’pore is part of China: Our flag: Did you know?. Or that all Chinese (PRC or ethnic) are Ugly?

What do u think?

M’sia and Indonesia are doing their bit to keep planet from overheating

In Environment, Indonesia, Malaysia on 29/06/2023 at 4:46 amSlower growth in 2023 for major Asean economies

In Economy, Indonesia, Malaysia, Philippines, S'pore Inc, Thailand, Vietnam on 26/06/2023 at 6:16 amChina’s influence in SE Asia has waxed. US of A’s has waned

In China, Indonesia, Malaysia, Philippines, S'pore Inc, Thailand, Vietnam on 14/06/2023 at 3:56 amForward this to PM-in-waiting and other millionaire PAP ministers

In Economy, Indonesia, Malaysia, Philippines, S'pore Inc, Thailand, Vietnam on 15/05/2023 at 11:10 amWhere our PAP millionaire ministers are happy to let M’sia outperform us

In Indonesia, Malaysia, S'pore Inc on 04/05/2023 at 1:36 pmWe are in a sweet spot cont’d

In Economy, Indonesia, Malaysia on 18/01/2023 at 8:46 amFour berths in Tuas Mega Port, have been completed. They are the first of 21 due by 2027. When it is completed in 2040, the complex will be the largest container port on Earth, boasts PSA International.

The IMF expects the region’s five largest economies—Indonesia, Malaysia, Singapore, the Philippines and Thailand—to be the fastest-growing bloc in the world by trade volumes between 2022 and 2027.

https://www.economist.com/interactive/business/2023/01/14/investments-in-ports-foretell-the-future-of-global-commerce

S’pore and other Asian countries that are waiting to welcome Chinese tourists

In China, Economy, Japan, Malaysia, Tourism, Vietnam on 09/01/2023 at 3:10 amWhy M’sia’s divides will get worse

In Malaysia on 24/11/2022 at 5:06 am(Alternative title: Why the moderates lost out in M’sian GE)

PAS the amputee party have the most seats: 44. The secular DAP a very Chinese party (though it claims to be multi-racial, the mamas in it are second class party members) have the second most with 40 seats. Add the role of religion to that of the racial divide. Things will get worse.

Yes, yes I know Islam is the state religion, but in practice M’sia was a secular country. Expect things to change if PN forms the next govt: PAS is the dominant party in that gang.

This chart shows why liddat:

The Malays, Chinese and mamas were very unhappy before the GE.

This is worrying for the minorities in M’sia:

“Support among Malay Muslims for sharia (Islamic law), which pas endorses but umno does not, has risen from 52% in 2011 to 75% today, says Ben Suffian of the Merdeka Centre, a pollster.”

https://www.economist.com/asia/2022/11/10/malaysias-grand-old-party-eyes-a-comeback/ Chart also from here

Btw, avoid investing in KSE stocks.

The difference between S’pore and M’sia

In Malaysia on 19/11/2022 at 3:17 pmPrices before or after bribes?

In Malaysia on 09/09/2022 at 5:23 pmWho in Asean is dependent on Ukrainian wheat?

In Commodities, Indonesia, Malaysia on 23/06/2022 at 3:08 amWhy M’sia is no longer popular with ang moh investors

In China, Financial competency, Malaysia on 20/06/2022 at 4:51 amNo not because Tun M is running the show.

No it’s because of China.

When the MSCI EM index — the benchmark for many equity funds — was launched in 1988, Malaysia was the biggest EM, with more than a third of the index. M’sian equity specialists like me were minting it. Even though I was based here, I didn’t do “S’pore”. It was boring and a waste of time. Btw, it’s still boring but S’pore stocks (and reits) now pay good dividends. Just the thing for me today.

China only joined the index in 1996, with a weight of just 0.46%.

Chinese equities now make up more than 30% of the MSCI EM, followed by Taiwan, India, South Korea and Brazil.

I told my ex-boss yesterday that he and his pals Tun and Anwar were in a sweet spot.

Why our millionaire ministers deserve their salaries?

In China, Commodities, Economy, Financial competency, Hong Kong, Indonesia, Malaysia on 11/05/2022 at 4:58 amThis year, NASDAQ in bear market (more than -20%) and S&P in correction (more than -15%). HK and China have been in bear markets since last year.

STI up 3% this year. And if palm oil keeps on flying, and Covid is under control in the region, expect the tourists from Indonesia and M’sia to come in.

Palm oil prices show how dysfunctional Indonesia is

In Commodities, Indonesia, Malaysia on 24/04/2022 at 3:31 am

Despite Indonesia being the world’s largest producer of palm oil,

Indonesia banned exports of palm oil, which is widely used in cooking and packaged foods, in a move that may well push up global food prices further. The country accounts for more than half of the world’s palm-oil supply. Indonesia’s president, Joko Widodo, said he wanted to ensure that the cooking oil remains “abundant and affordable” at home, where prices have rocketed.

Economist

Time to invest in M’sian consumer shares? M’sia is the world’s second- largest producer of the commodity after Indonesia.

Will help our tourism? All those country bumpkins coming here.

PSA: The Good and the Bad

In Logistics, Malaysia, S'pore Inc, Shipping on 16/10/2021 at 4:47 amOur ports don’t have the problems that some other major ports are facing. Delays here are relatively minor.

But PSA isn’t that efficient. Two of M’sia’s nearby ports are a lot more efficient.

But to be fair, they most probably don’t have much business most of the time. S’pore is bunched together with many other busy ports.

Contrarian play?

In Commodities, Malaysia on 26/08/2021 at 6:18 amBuy M’sian consumer shares?

When I was in broking in the 90s, when palm oil prices were expected to cheong we got clients into M’sian consumer stocks. It was an easy sell as M’sian stocks were hot.

Time to try that trope again despite the economic woes caused by the pandemic and political uncertainty?

Asean currencies V US$

In Currencies, Emerging markets, Hong Kong, India, Indonesia, Japan, Malaysia on 07/08/2021 at 8:49 amCovid-19: Spare a tot for our neighbours

In Indonesia, Malaysia on 03/08/2021 at 4:07 amUnlike us, they don’t have millionaire PAP ministers.

Low vaccination rates and the rapid march through the region of more transmissible variants of covid-19 mean that almost every country is experiencing its worst wave yet. This month Indonesia surpassed India as Asia’s hotspot. With oxygen supplies dwindling and hospitals overcrowded, some health-care systems are near collapse. Death rates are soaring: Indonesia, Malaysia and Myanmar were among the 20 countries with the most deaths per million people in the week to July 29th. Myanmar in particular is hoping that it will be able to tap into ASEAN’s covid-19 fund. Just 3% of its population is vaccinated.

Yesterday’s Economist Expresso

Low vaccination rates hurts 4 Asean countries

In Indonesia, Malaysia on 01/08/2021 at 5:25 amIn Be thankful we got PAP govt, I showed a chart showing that M’sia and Thailand had serious problems with mama variant. The second chart below explains why: low vaccination rates in these countries.

Then there’s this too

ASEAN-5” refers to Indonesia, Malaysia, the Philippines, Singapore, and Thailand. Indonesia and PinoyLand also have low vaccination rates.

Asean blues but we are going great guns

In Economy, Indonesia, Malaysia on 12/07/2021 at 1:49 pmModified at 2.49 pm on day of publication to include data on S’pore.

Economists have slashed their GDP growth forecasts for Malaysia, the Philippines and Thailand, three of the region’s biggest economies.

But for S’pore, MAS has revised higher the economic growth forecast for 2021 and expects that GDP growth could go beyond the initial 4%-6% yoy range forecasted.

• MAS Chief Ravi Menon stated that the increase comes on the back of a smooth

vaccination scheme (36.7% fully vaccinated so far) and stronger global demand.

• Inflation numbers for 2021 were also revised higher, with the forecast for headline CPI

increased to 1.0%-2.0% yoy, up from 0.5%-1.5% yoy.

A bad outlook for tourism is the main reason for dimmer prospects in Thailand. Vaccinations are sluggish and hospital beds are running short. Tourists will stay away.

Pandemic restrictions are another drag on regional growth. With many shops shut, Malaysia’s and the Philippines’ prospects don’t look good.

Although growth forecasts have been revised upward for Indonesia, the region’s biggest economy, daily infections there have surged by 500% in recent weeks.

The greatest risk for South-East Asian economies may be America tightening its monetary policy sooner than expected, which would increase the value of the dollar and make corporate dollar-denominated debt more expensive. GDP forecasts may fall further yet.

Economist

M’sia quietly destroys forests, avoiding being named and shamed by the woke

In Malaysia on 02/06/2021 at 6:20 amJohor Chief Minister think S’pore stupid isit?

In Malaysia on 22/04/2021 at 4:16 amJohor’s chief minister said on Tuesday (Apr 20) his state government will propose measures that will limit the movement of workers who cross the border from Johor to Singapore.

Hasni Mohammad said the reopening of the border was an “ongoing agenda” of his state government and that it would would ensure that those involved in crossing the border from Johor, like workers, received the COVID-19 vaccine.

https://www.channelnewsasia.com/news/asia/johor-malaysia-singapore-meeting-covid-19-border-14657708

Malaysia is looking at the potential of a fourth wave of Covid-19 infections. Daily cases picking up to above 2000 for the fourth day running as at Monday. Fatalities have gone up in recent days. There are concerns that Ramadan will add to the tallies in the coming weeks.

Why didn’t China offer us this?

In Malaysia on 24/10/2020 at 11:05 amDuring China’s foreign minister’s recent Southeast Asian tour, when he visited Malaysia, Malaysia was promised priority access to China’s COVID vaccine. China also announced plans to purchase large volumes of palm oil, Malaysia‘s core export,

Got six properties but driving Grab to earn $?

In Financial competency, Financial planning, Malaysia on 07/10/2020 at 6:41 amGive me a break pls from this kind of BS, constructive, nation-building MediaCorp.

OK. OK the properties are M’sian, not S’porean but this sounds like a lot of bull.

It reports

Retiree SK Quek leases five of his six properties in Malaysia and used to put up two of the houses for short-term rental on Airbnb.

Read more at https://www.todayonline.com/singapore/sporeans-homes-malaysia-limbo-due-border-restrictions-some-paying-double-living-costs

And while he has no issues with collecting rent from his long-term tenants, the 64-year-old who is now driving for Grab in Singapore said he loses about RM8,000 a month — his usual earnings from Airbnb — for not being able to list his properties.

Can’t stop laughing is disbelief that a six property man (I assume he also has something here even if it’s a three room HDB flat) is driving Grab to earn a living. Must be BSing about his properties. What do you think?

As for the other S’poreans mentioned in article KPKBing that they got two properties etc to maintain, they should sit down and shut up. Btw, I’m sure pre Covid-19, they were sneering at S’poreans who didn’t stay in M’sia and commute here regularly.

They made their choices, and gotta live with the consequences. But so typical of Singkies: vote for PAP but then KPKB about kanna Pay And Pay. Reminds me of what the Mexican bandit leader said in the Magnificent 7 about the peasants he regularly shook down: “If God did not want them sheared, He would not have made them sheep.”

Likewise it’s something the PAP could say, but hasn’t yet.

Bye bye Thai

In Indonesia, Malaysia on 01/10/2020 at 4:25 amForeigners have been selling Thai stocks, and Ms’ian and Indon stocks too. Thailand is in the same category of foreigners fleeing as Brazil and Korea.

In Thailand, investors are concerned about the protests against the govt and the monarchy.

Covid-19: Must be India again

In India, Malaysia on 03/09/2020 at 4:27 amNew Zealand reported 14 new cases of Covid-19 on Tuesday, seven of whom arrived in the country from India. Trying to do to NZ, what they did to S’pore? Covid-19: FTs from India reinfecting S’pore.

M’sia has the right attitude: M’sia has jux barred entry for long-term pass holders from India, Indonesia and Philippines. Decision made after considering the surge in the number of COVID-19 cases in the three countries.

Pinoys: Asean tua kees

In Emerging markets, Indonesia, Malaysia, Vietnam on 06/05/2020 at 9:38 amThat was my first tot when I looked at the u/m chart on a ranking of financially stronger/ weaker emerging economies .”M’sia tak boleh” was my second tot.

The Asean ranking: PinoyLand (6th), Thailand (7th), Vietnam (12th), Indonesia (16th) and M’sia (25th).

Btw, S’pore’s not ranked because it’s not an emerging economy (except in accountability: S’pore: Bottom of developed world), but South Korea and Taiwan are still emerging economies, even if Korea is a member of of the OECD.

Covid-19: Must be Tablighi Jamaat again

In India, Indonesia, Malaysia on 02/04/2020 at 4:22 pmTablighi Jamaat, an influential Islamic missionary movement, with its HQ in a New Delhi slum, is now responsible for super-spreading Covid-19 in India after doing it in M’sia and Indonesia: Covid-19 in Islamic countries. In Indonesia and M’sia, it was their mass gatherings that caused serious problems. It also affected S’pore because some of people in the M’sian gathering returned to S’pore.

The Tablighi Jamaat have come into the spotlight after an event they held in the Indian capital Delhi has spawned a number of Covid-19 clusters across the country. But exactly who is this group and why did they hold a big gathering in Delhi? BBC Hindi’s Zubair Ahmed reports.

https://www.bbc.com/news/world-asia-india-52131338

With an irresponsible organisation like Tablighi Jamaat, Muslims have to be afraid, very afraid of being cast as disease carriers in India, M’sia and Inonesia. The people who don’t like Muslims and want to hurt them can only be pleased that Tablighi Jamaat was so socially irresponsible in three countries.

With an organisation like Tablighi Jamaat, Muslims don’t need enemies. Time for Muslims to do some serious soul-searching.

Codvid-19: Why God is a S'porean

In Economy, Malaysia on 19/03/2020 at 4:09 amI tot the above when I read

Malaysian Prime Minister Muhyiddin Yassin has assured Singapore Prime Minister Lee Hsien Loong that the flow of goods and cargo between Singapore and Malaysia, including food supplies, would continue, Mr Lee said on Tuesday (Mar 17).

Mr Lee’s remarks came after Malaysia announced it would bar citizens from going overseas and foreigners from entering the country for about two weeks starting Wednesday

https://www.channelnewsasia.com/news/singapore/singapore-malaysia-cargo-goods-border-restrictions-12547142

If Tun had been in charge, there’d be no no free flow of food and goods to S’pore. He’d have use the emergency measures meant to suppress the Wuhan virus to cut off food supplies and goods.

He’d also have ensured that the M’sian workers who regularly commute her to work, would not be able to come and stay here for the next two weeks.

Both these would cripple our economy and hurt us but he’d have the excuse of the need to suppress the spread of the virus.

Where he has tried to bully us recently:

Water: Why Tun should thank S’poreans

What Tun and our alt media don’t tell us about the water supply from Johor

Tun manufacturing another row to stir his anti-PAP S’porean fans?

Tun chickened out/ Two cheers for cowardly PAP govt

Yet PJ Thum, Kirsten Han and Jolovan Wham (Nothing wrong in asking Tun M to intervene in S’porean affairs) want to lick his ass

——————————————————————————

He likes to try to bring S’pore to its knees or at least make us try “Tolong”, as the links in the above box shows. And attempts to suppress the Wuhan virus in M’sia would have given his reasonable excuses to hurt S’pore and S’poreans.

Muhyiddin, like Najib, are people we can do business with. As would Anwar.

God loves S’pore.

NUS academic defends M’sian king and Muhyiddin

In Malaysia on 10/03/2020 at 4:43 amFurther to King’s snub to Tun is payback time, where I reported that the word in KL was that unhappiness with Tun’s attitude towards the sultans (and Pahang’s royalty in particular) played a big part in the king declaring that Mr Muhyiddin had the numbers to be sworn in as the country’s eighth prime minister. It wasn’t that the king couldn’t count

Mustafa Izzuddin, from NUS, thinks the king did no wrong:

“The King cannot make political decisions,” says Mustafa Izzuddin at the National University of Singapore.

“But he can play the role of honest broker, bringing the warring sides together. Even then it is unprecedented for a king to do so in Malaysia.

“But Malaysian politics are in uncharted waters, so revolutionary methods may have been necessary. And the King may have seen Muhyiddin as the most trustworthy and steady of the candidates.”

He can look forward to a royal honour if Tun and gang cannot unseat Muhyiddin.

King’s snub to Tun is payback time

In Malaysia on 09/03/2020 at 6:13 amAfter being reinstated as interim prime minister by the king, Mahathir seemed poised to form a new government that may have sidelined his designated successor Anwar Ibrahim. But then almost quickly, Mahathir and Anwar were once again united in an attempt to form a new government when UMNO ans PAS called for a GE.

But M’sia’s constitutional monarch, King Abdullah (whose role it is to invite a candidate to form a new government), declared that Mr Mujaheddin had the numbers, and would be sworn in as the country’s eighth prime minister. This was done and the new appointment has been called a royal coup by the favourite ang moh newspaper of ang moh tua kees, PJ Thum and Kirsten Han (Remember them? Kirsten Han trying to defecate herself and PJ out of self-made crater)

Tun Mahathir has challenged Mujaheddin’s appointment and plans to try to bring the new government down once parliament meets again. But the problem is that the parliament won’t be meeting until mid May, giving Mujaheddin time to use his powers of patronage as PM to get the votes needed to secure his position.

Tun and gang have published a list of 114 MPs (the minimum necessary needed to secure a majority is 112) who gave him their statutory declarations promising him their votes. Mujaheddin hasn’t publicly announced such a list and the word in KL is that he doesn’t have the numbers

So king can’t count isit? Another Xia suay, like Tun who really had no good reason to resign.

Not really because as the BBC reports,

It is worth recalling too that Mr Mahathir has a history of conflict with Malaysia’s sultans, something that may have been a factor in the King’s choice.

Back in 1983 and 1993 he pressed for constitutional changes that imposed limits on royal power.

“In the earlier crisis the role of leading royal resistance to Mahathir was played by the then-Sultan of Pahang, the current king’s father,” says Clive Kessler at the University of New South Wales.

“Memories and resentments linger on and are not easily forgotten or set aside.”

(Pahang’s then sultan was king for five years during Tun’s reign and was king when Tun was king of the jungle.)

Obviously Tun never tried to mend fences with Pahang. He never really does with anybody.

The nearest Tun will get to giving an apology is illustrated by the following tale.

A benefactor and friend who got seriously rich during Tun’s tenure as PM but who fell into his bad books (Unfairly in friend’s view, but he would say that wouldn’t he?) during the 1998 financial crisis, once told me that after Tun retired, he was invited to a personal lunch by Tun who told him, “Let bygones be bygones.”. This to a man who had to endure investigations and other indignities, excluding the probability of losing most of his wealth.

Whatever, we recently spoke, and he told me that all the Malay leaders (Tun included) still call him a “friend”: meaning he’s still rich enough to be shaken down for donations.

Related post: Simple guide to M’sian politics.

Simple guide to M’sian politics

In Malaysia on 27/02/2020 at 5:16 amOr “Why 37 MPs ratted on Perkatan Harapan and outsmarted themselves”.

Bersatu’s 26 MPs (This technically includes Tun and his son) led by Bersati president Muhyiddin Yassin) and 11 MPs (led by Azmin Ali) from Parti Keadilan Rakyat (PKR), the largest party in Pakatan Harapan (PH), left the coalition earlier this week, leaving it without a parliamentary majority. Before the departures, the coalition had 129 MPs. To form a government, any coalition must have a minimum of 112 out of the 222 members of parliament. PH is 17 MPs short.

Tun is now the interim PM, while the king decides what to do.

Politics is all out race

About 69% of Malaysia’s 32m people are Bumiputra: Malays and other indigenous groups. A further 24% are ethnic Chinese and 7% Indian. The Malays have historically supported UMNO because it champions and defends policies to boost them economically. Bersatu, founded by Tun and Muhyiddin does too. The Chinese and Indians resent the privileges accorded to Malays. The DAP represents Chinese interests and supposedly Indian interests; PKR, led by Anwar, supposedly embraces multiculturalism.

Why did the 37 quit the coalition? One reason is an attempt to ensure that Anwar doesn’t get to become PM, another is to keep Tun in power. But an important reason is that many of them are scared of losing their seats in a GE.

Shortly after Pakatan Harapan won power, 63% of Malays thought the country was “going in the right direction”, according to the Merdeka Center, a pollster. Within two years that share had plummeted to 24%. And PH keeps losing by-elections: 5 in all so far.

Mahathir could now try to form a government with parties who remain in the coalition, backed up by new support from elsewhere (Think Sawawak’s governing party, PBB and its pals who have 18 MPs*). They have told him to f-off, coming out to say they want Anwar as PM. Looks like whatever Anwar and Lim Guan Eng (head of DAP) said publicly in support of Tun’s resignation (He said he didn’t want to team up with UMNO), there’s disbelief in PH that he didn’t known his party president and Amin were talking to UMNO and PAS.

Or he could follow his traditional supporters who have abandoned the ruling coalition, and team up with those he removed from power in 2018 (UMNO and friends). UMNO and PAS have told him that they want a GE. Sawawak’s governing party, PBB and its pals who have 18 MPs* “say” that they’ll support him.

He could also step back, and make way for a race between Anwar, Azmin and figures from his own party, Bersatu.

Fun fact: According to his website, Azmin was born in Singapore in 1964 as the fourth child of six siblings. His father, Haji Ali Omar, was in the Malaysian army, in 1968, he returned to Malaya.

—————————————————-

*Parti Pesaka Bumiputera Bersatu (PBB), Parti Rakyat Sarawak (PRS), Progressive Democratic Party (PDP) and Sarawak United People’s Party (SUPP) formed a new coalition called Gabungan Parti Sarawak (GPS).

Why has M$ strengthened against S$?

In Currencies, Economy, Malaysia on 10/02/2020 at 11:10 amLast week, the Singapore dollar fell below the RM3 mark for the first time in about a year after our said central bank said there was sufficient room for the Singapore currency to ease as the Wuhan virus hits the economy: S$ tanks as GDP forecasts slashed

It’s now at M$2.98.

Bit surprising that the M$ has strengthened against S$ and outperformed it vis-a-vis the US$ because while S’pore is intensive care when China sneezes, M’sia dies: China sneezes, S’pore in intensive care.

Ang moh investors were net sellers of all things M’sia since 2018 when Tun came into power and are so going into this crisis, they very underweight M’sian assets. Hence had nothing much to sell. They were also especially overweighted S’pore because of the HK crisis. And so had a lot to sell to get to an underweight position.

Tun must be happy.

Property: Get excited about M’sia, Manila

In Malaysia, Property on 17/01/2020 at 5:16 amVictoria Garrett, head of residential, Asia Pacific, at Knight Frank writes

The Knight Frank Prime Global Cities Index, which tracks the movement in luxury residential prices across 45 cities, saw 1.1 per cent average annual price growth in Q3 2019, down from 3.4 per cent for the same period in 2018, with secondary cities in Asia — including Taipei, Manila, Guangzhou and Delhi — creeping into the top 10. We expect those markets with strong local economies (Manila, Shanghai and Taipei) to perform strongly in 2020 as well as those cities where wealth forecasts are above the regional average (Bengaluru, Manila, Guangzhou, Ho Chi Min City). [Note she doesn’t mention us. LOL.]

Manila’s prime residential market continues to sprint ahead, with prices rising 5.6 per cent in the first nine months of 2019, adding to the 11.1 per cent rise seen in 2018, according to Santos Knight Frank Research. This is driven by investors buying prime residential property to lease out to employees working in business process outsourcing (BPO) and for Philippine offshore gaming operators. While there are some supply concerns this year, demand should keep pace, and we expect prices to continue rising given the ever-expanding BPO sector.

Malaysia’s residential property market appears to be bottoming out, although it will take time before the market sees a significant improvement. We expect the market to improve gradually with support from government initiatives. The lowering of the price threshold for foreign buyers from RM1m to RM600,000 ($243,000-$146,000) in 2020 for unsold high-rise units in urban areas is expected to help address the overhang, particularly for units in the RM600,000 to RM700,000 range in selected areas.

Remember you read this here first.

Related post: Soon can buy M’sian apt for less than 2-room HDB flat

Tun talks cock, Mamas upset, M’sian palm oil growers suffer

In India, Malaysia on 02/01/2020 at 4:36 amPalm oil is M’sia’s biggest agricultural export, used extensively around the world, in everything from cooking oil, to bio-fuels, and een in lipsticks. Hundreds of thousands of M’sian farmers depend on palm oil exports for their livelihood,

India, the world’s biggest importer of edible oils, buys more than 9m tonnes of palm oil annually, mainly from Indonesia and Malaysia. Between January-October 2019, India was the biggest buyer of Malaysian palm oil, taking in more than 4m tonnes, according to official M’sian data.

But its palm oil exports to India dropped from 310,648 tonnes in September to 219,956 tonnes in October – and then to 142,696 tonnes in November.

Because in late September, Big Mouth Talk Cock King Mahathir said India had “invaded and occupied” Kashmir, the Himalayan territory that is legally part of India. Delhi had only revoked Indian-administered Kashmir’s autonomy in early August, and communication and other curbs remain in place.

Indians were unhappy, and India’s top vegetable oil trade body called on its members to avoid buying M’sian palm oil to “show solidarity” over Kashmir.

As hundreds of thousands of M’sian farmers depend on palm oil exports for their livelihood, the M’sian government has admitted the advisory was a “major setback”. -Tun went further, saying it “amounts to a trade war”.

Experts agree that it’s “major setback”.

“If there is a formal boycott, it will hit M’sia hard in the short term,” James Chin, director of the Asia Institute at the University of Tasmania, told the BBC. “It will be very difficult for Malaysia to find a new buyer for the volume.”

S’poreans should behave like the Mamas when Tun next threatens us.

Soon can buy M’sian apt for less than 2-room HDB flat

In Malaysia, Property on 26/11/2019 at 11:04 amFrom next yr, foreigners can buy property in federally-governed territories (mostly areas in and around KL), for only 600,000 ringgit (S$198,000: S$200,000 seems to be the value of a 2-room HDB flat in Bedok) following a move by Tun’s government to slash the threshold for foreign buyers by 40% to address an oversupply of high-rise units.

While the central government intends to lower the threshold for units in federally-governed territories next year, individual state governments are not compelled to follow suit.

Although leaders from Penang, Selangor and Johor – states suffering from an oversupply of high-end condominium units – have said they are reviewing their foreign-ownership property thresholds, two of the states have said that the 600,000-ringgit figure is too low.

In some states, foreign buyers are currently limited to property priced at 2 million ringgit(US$480,000)or above.

————————————–

Related posts:

What a 4-room HDB flat buys in Iskandar & KL

Iskandar: Dummies Guide on why it’s rubbish

I’ll end with

Li [a taxi driver in HK] was amazed at how “cheap” apartments in Singapore are. He lives with his parents in a one-bedroom apartment that is worth HK$6.5 million (US$830,000). He cannot afford to move out and, with his fourteen-hour days, has neither the time nor money to date.

https://sudhirtv.com/2019/11/15/a-longform-on-hong-kong-vs-singapore/

M’sian SOE debt at dangerous level

In Energy, Malaysia on 23/11/2019 at 3:53 amMuch of the deterioration in finances and credit ratings in developing countries state-owned enterprises are

due to the predominance of oil and gas companies among SOEs, Cnooc and Sinopec of China, Gazprom of Russia, Petrobras of Brazil and Malaysia’s Petronas as well as Pemex, which have been hurt by the fall in oil prices since 2007.

FT

Emphasis mine.

Want Tun to run S’pore?

“Singapore water issue a legacy of Mahathir: Malaysian minister”

In Infrastructure, Malaysia, Media on 15/11/2019 at 5:24 amScreamed an AsiaOne (part of the constructive, nation-building SPH and stable-mate of ST) headline

The unresolved issue of the price of water sold to Singapore was a legacy of Tun Dr Mahathir Mohamad, says Datuk Seri Dr Wee Ka Siong (BN-Ayer Hitam) (pic).

He said this as he reminded a Johor lawmaker, who raised the issue when debating Budget 2020 in Parliament yesterday.

[…]

Dr Wee [reminded] it was Dr Mahathir who decided not to raise the water tariff on the sale of water from Johor to Singapore.

“As far as I know, this was done in 1987 when YB Langkawi was the Prime Minister then*.

Wow! Except that the said Dr Wee is not a Malaysian minister. He’s an ex-minister who was in Najib’s cabinet. Surely not the same.

Morphing an ex-minister from a Najib cabinet into a present-day minister in a Tun cabinet sounds like fake news from our constructive, nation-building media. But I doubt, it’ll get POFMAed by the PAP govt.

Btw, in What Tun and our alt media don’t tell us about the water supply from Johor, I wrote

So funny that in 1987 when he could taken action to have the agreement reviewed, he didn’t bother. Actually to be fair to him, it seems he wasn’t told that in 1987 there was a window for review . Secret Squirrel says that there’s a view in M’sia that someone was bribed. It was not some Bumi incompetence or carelessness.

*The exchange went on

“He decided not to raise the rates. So what are your views as the fourth Prime Minister is now the seventh Prime Minister?” Dr Wee asked.

In response, Santhara said things were different now as Dr Mahathir made the decision back then when he led the Barisan Nasional government.

“But now, he sits in a Pakatan Harapan Cabinet and is the Prime Minister and Pakatan chairman.

“The thinking now is to resolve the problem, ” he said.

Dr Wee then pointed out that the time to resolve the water agreement with Singapore has since passed.

S’pore: Bottom of class in Asean

In Economy, Indonesia, Malaysia, Vietnam on 09/11/2019 at 4:47 amDon’t believe me? Look at this table where MNCs relocating from China are going to.

To be fair, S’pore’s a developed city-state while the rest of Asean are third-world countries: including M’sia.

Btw, table also shows that PeenoyLand and Indonesia are “shithole” countries as far as manufacturing investments are concerned. Infrastructure problems, poor governance and bad labour and other laws ensure that MNCs don’t relocate there despite cheap labour and in Peenoy’s case, the use of some kind of English.

Hoping for Perkatan Harapan type victory here?

In Malaysia on 28/10/2019 at 3:44 amThen expect bad economic growth. Look at the chart below and realise that it was the economy that did it for Najib. It tanked badly during his last year

Btw, why rational S’poreans should be afraid, very afraid that a Coalition of the Spastics wins: My predictions about Spastics’ League, False Hopes: Coalition of the Spastics and Election manifesto of Spastics League?.

What Tun and our alt media don’t tell us about the water supply from Johor

In Infrastructure, Malaysia on 21/10/2019 at 4:51 amI’m sure you know:

Under the 1962 Water Agreement, Singapore can draw up to 250 million gallons of water a day from the Johor River, and Singapore is obliged to provide Johor with treated water up to 2% of the water we import. The 1962 Water Agreement will expire in 2061.

PUB

And that we pay 3 sen per 1,000 gallons and are required to supply Johor with 5 mgd of treated water at cost under the agreement.

And that Tun keeps KPKBing that it’s an unfair agreement that he says must be changed.

—————————————————-

So funny that in 1987 when he could taken action to have the agreement reviewed, he didn’t bother. Actually to be fair to him, it seems he wasn’t told that in 1987 there was a window for review . Secret Squirrel says that there’s a view in M’sia that someone was bribed. It was not some Bumi incompetence or carelessness.

——————————————————

But did you know an area about a third the size of Singapore (21,600 ha) is leased from Johor?

Constructed by PUB under a 1990 agreement with Johor supplementary to the 1962 Water Agreement, the Linggiu Reservoir is located upstream of the Johor River Waterworks and releases water into the Johor River to supplement its flow. This enables reliable abstraction of raw water at the Johor River Waterworks which is owned and operated by PUB for treatment.

https://www.pub.gov.sg/watersupply/fournationaltaps/importedwater

PUB

built the Linggiu Reservoir at a cost of more than S$300 million to enable reliable abstraction of water at PUB’s Johor River Waterworks (JRWW).

PUB (This sentence added on 22 October 2019 at 4.55am)

We paid Johor RM320 million (S$208 million at 1990 rates) for the potential loss of revenue from logging activities, and as a one-time payment for the lease of that land for the land up to 2061. We pay annual land taxes: but this is “peanuts”.

Do you know that despite leasing the land and using it as a catchment area, Malaysia, can, built water plants upstream of the JRWW?

These

have further added to the abstraction of water from the Johor River.

Also, did you know we have been supplying more than 16 mgd of treated water to Johor at the state’s request? Only obliged to supply 5 mgd.

PUB revealed that from Sept 23 to Sept 27, it has been supplying an additional 6 mgd of treated water, on top of the 16 mgd that it already supplies. This is upon Johor’s request, as the state had seen a disruption in production at its water plant in Skudai, PUB said.

M’sian stocks: eagles and dogs

In Financial competency, Malaysia on 20/10/2019 at 10:20 amInteresting tables from https://www.theedgesingapore.com/capital/tongs-portfolio/good-bad-and-ugly-our-malaysian-portfolio-reaches-its-fifth-anniversary

From the late 80s until the late 90s, I used to specialise in M’sian equities. These stocks are Mandarin to me. LOL.

SAF can really detect and neutralise drones?

In Malaysia on 18/10/2019 at 5:17 amAfter the attack on Saudi oil installations, in what seems to be warning to Tun not to try anything funny (Morocco Mole, Secret Squirrel’s side kick tells me that his second cousin removed working in Tun’s office tells him that arms dealers have promised him Iranian drones that hit the Saudi installations.)

Singapore ‘quite confident’ of detecting and neutralising drones used in Saudi attacks: Ng Eng Hen

Headline from constructive, nation-building CNA

Read more at https://www.channelnewsasia.com/news/singapore/singapore-confident-detect-neutralise-drones-saudi-arabia-uav-11976108

Is he talking cock?

Because remember the drone intrusion at Chamgi Int’l? Why isn’t Changi Int’l not protected against drone intrusions?/ Paper weapons?

and

But let’s be serious

But it would be a mistake to confuse the use of drones or UAVs (unmanned aerial vehicles) in this attack with other incidents where off-the-shelf drones have disrupted airports, football matches or political rallies, says Douglas Barrie, an air power fellow at think tank the International Institute for Strategic Studies.

He says this attack was carried out, in part, by sophisticated UAVs – small, pilotless, winged aircraft – nothing like the quadcopter drones flown in suburban parks.

Instead, they can cover hundreds of kilometres and be pre-programmed to fly around navigation points on the ground, allowing them to approach a target from an unexpected direction.

“The level of complexity in this attack is above anything we’ve seen before. Using a mix of cruise missiles and unmanned air vehicles (UAVs) that arrived all at the same time calls for a serious level of planning and proficiency,” says Mr Barrie.

The attack has raised a question-mark over the quality of the protection available against UAV assaults.

Criticism of Saudi Arabian air defences is wide of the mark, says Mr Barrie. The fact is that complex networks of air defence radars linked to guided missiles and squadrons of advanced fighter jets are not designed to counter this relatively cheap and disposable technology.

“Digital technology has made a huge difference to what smaller UAVs can do. Suddenly you can pack a lot into a UAV, you can almost turn it into a precision guided weapon.”

By programming a UAV to fly around numerous points before arriving at its target it can avoid the obvious directions from which an attack is expected. This may explain why existing radars failed to spot the drone formation which attacked Abqaiq.

Which is why this got rushed into the area

The US Air Force has just taken delivery of Phaser, a microwave-based weapon from defence giant Raytheon. Firing from a disc resembling a giant satellite dish atop a sand-coloured container it wipes out the digital elements inside a drone.

Raytheon cannot say where the rapidly purchased Phaser has been sent, but the Pentagon has stated that it is being deployed overseas.

Perhaps Phaser’s biggest strength is it operates at the speed of light. That is the rate at which it fires out bursts of microwave radiation. And that can bring an approaching UAV down in a split second.

The beam emitted by Phaser is 100 metres broad at a distance of one kilometre. That translates into a lot of dangerous space for an attacking UAV. Targets are tracked by an electro-optical sensor converting images into electronic signals and working in tandem with the microwave beam.

Water: M’sia takes us to the cleaners/ What? Shades of Oxleygate?

In Infrastructure, Malaysia on 02/10/2019 at 10:35 amOver water issues with M’sia, the PAP govt is still playing nice guy. Or to be more accurate, roll over and play dead.

Our constructive, nation-building CNA reports (emphasis mine), not Terry Online’s Channel bunch of M’sian Indian goons trying to fix S’pore by destabilising bi-lateral ties by publishing fake news, reports this disturbing news:

“Singapore built the Linggiu Reservoir at a cost of more than S$300 million to enable reliable abstraction of water at PUB’s Johor River Waterworks (JRWW),” the agency [My note: PUB] said in a media release.

“However, Malaysia has built water plants upstream of the JRWW, which have further added to the abstraction of water from the Johor River.

“This challenging situation is exacerbated during dry weather, as PUB needs to discharge more water from Linggiu Reservoir to support water abstraction.

“In the event of a prolonged drought, a depleted Linggiu Reservoir will compromise Singapore’s right to abstract our full 250 million gallons per day (mgd) entitlement of water under the 1962 Water Agreement.”

Under the 1962 agreement, which lasts until 2061, Singapore has full and exclusive right to draw up to 250 million gallons of water daily from the Johor River at the price of 3 sen per 1,000 gallons.

Read more at https://www.todayonline.com/singapore/water-level-linggiu-reservoir-johor-falls-below-50-cent-pub

So why we playing nice guy? We continue giving Johor more cheap water then required to out of “goodwill” to ingrates (Johor officials always saying water agreement is unfair and should be cancelled):

Singapore is also required to supply Johor with 5 mgd of treated water under the agreement. But in practice, the Republic has been supplying 16 mgd of treated water to Johor at the state’s request, PUB said.

On Saturday, PUB revealed that from Sept 23 to Sept 27, it has been supplying an additional 6 mgd of treated water, on top of the 16 mgd that it already supplies. This is upon Johor’s request, as the state had seen a disruption in production at its water plant in Skudai, PUB said.

“Johor made similar requests this year in January and August. Last year, Singapore supplied additional water in excess of the usual 16 mgd for 20 days,” PUB said.

The water agency added that it has supplied all the additional treated water above 5 mgd on a “goodwill basis” at the same price as under the 1962 agreement of 50 sen per 1,000 gallons — a fraction of the cost of treating the water.

Read more at https://www.todayonline.com/singapore/water-level-linggiu-reservoir-johor-falls-below-50-cent-pub

Goodwill? What goodwill? With the M’sian and Johor authorities forever trying to cause trouble,

Tun manufacturing another row to stir his anti-PAP S’porean fans?

M’sian minister thinks M’sian drivers tua kee

Let’s gloat at Tun as he threatens us,

we should stick to the letter of the law.

PM should stand up to Tun. No more nice guy. No more rolling over and playing dead. Like he did over Oxleygate, where he should have sued his siblings: Riposte to “Blood is thicker than water” and other BS reasons not to sue.

What PAP and PMs always did before Oxleygate: Why PAP (and PMs) sue and sue.

And do remember that Mad Dog always says S’pore is unfair to its neighbours. Surely, not in this case?

M’sia boleh: Growing bamboo on Mars

In Malaysia on 14/09/2019 at 10:38 amAccording to Dezeen, an architecture and design magazine, M’sian designers Warith Zaki and Amir Amzar have designed a “colony” made from bamboo that would be grown on Mars and woven into pod-like structures by robots..

“Bamboo alone might not work in the extreme climate conditions on Mars, but with a combination of technology and other materials, there would be possibilities,” they said.

What Tun planning to go one up on Xi (Chink on the moon) and Modhi (Soft landing on the moon) with a mission to Mars that will seed the planet with bamboo shoots?

Tun manufacturing another row to stir his anti-PAP S’porean fans?

In Malaysia on 09/09/2019 at 2:51 pmAnd distract M’sians from local problems? Like the haze, cabinet infighting and ebbing support from Malays for his personal party?

Tun and his Chinese lackey discriminating against us to cause trouble between the countries and among S’poreans isit? Why liddat? They know people like Goh Meng Seng and Terry (Or rather one of his India-based writers) of Terry”s Online Channel sure to take side of M’sia whatever the facts: What Meng Seng and TOC don’t tell us about dispute with Tun and “Licking the ass of the enemy of my enemy”.

As will PJ Thum, Kirsten Han and Jolovan Wham (Nothing wrong in asking Tun M to intervene in S’porean affairs)

How Hongkies justify flying US flag

PJ, Kirsten Jovolan and Meng Seng can use this reasoning to wave M’sia’s flag and support Tun

The US flag is about freedom and bravery,” said one, a 30-year-old who gave his name as Peter. “It’s not about supporting the US government, it’s about the value behind the flag no matter who the US president is at the time. The flag and the freedom doesn’t change.

Quote from FT

They can ignore that that there official discrimination of Chinese and Indians in M’sia.

————————————————————

Waz the latest row all about?

Our transport ministry will “consider the appropriate response” if M’sia applies its Vehicle Entry Permit (VEP) requirement only on Singapore-registered vehicles, MOT said last Friday.

In April, M’sia announced that all foreign vehicle owners coming into the country through land borders will have to register for a VEP starting October. Only VEP-registered vehicles will be allowed entry into M’sia.

The VEP would be implemented in stages, starting with vehicles entering from S’pore through Bangunan Sultan Iskandar and Kompleks Sultan Abu Bakar, Johor. Fair enough as most of this traffic from other countries is from S’pore.

The second and third phases will eventually include all land borders connecting Thailand, Brunei and Indonesia to M’sia. Fair enough because there’s minimal traffic from these countries.

But last Monday, Tun’s Chinese running dog from the DAP Transport Minister Anthony Loke was quoted by Sin Chew Jit Poh as saying that his ministry was still studying how to implement the VEP at these other borders.

Sounds like we are being discriminated against.

It is not clear from Mr Loke’s latest comments whether the VEP will be implemented at the land borders with Thailand, Indonesia and Brunei, and how much later, said MOT.

“If Malaysia’s VEP requirement is only applied on Singapore-registered vehicles, we will consider the appropriate response,” MOT said in its statement.

S’pore bidding for 2032 Olympics?

In India, Indonesia, Malaysia on 14/08/2019 at 7:22 amMalaysia and Singapore are reportedly considering a joint bid,

In a story about Indonesia’s planned bid, the NAR reported the above. It also reported that India was planning a bid and the idea of a North-South Korea bid has also been floated.

It says that India would pose the greatest threat to Indonesia succeeding.

Why Sino-US Cold War is great for our economy

In China, Economy, Indonesia, Malaysia, Vietnam on 22/07/2019 at 5:37 amIt’ll do for our economy what the Vietnam War did for HK and our economies: spur economic growth

Further to Will the last US MNC leaving China switch off the lights, the charts below show almost nothing is made in America. Almost everything is made in China, and almost the rest in Asean i.e. countries like Vietnam, Indonesia and M’sia.

As the regional trading, financial heart and hi-tech manufacturing centre (Think Ang moh manufacturer employs more people here than in China and planning to employ a lot more) of Asean, we’ll benefit (Think Ang moh who bot S$73.8m flat).

Bang yr balls Oz-based TRE cybernut and funder “Oxygen”. Left S’pore a long time ago but still hates S’pore and wishes us ill. But still has CPF account. Used to evade Oz tax, it’s alleged by Secret Squirrel.

But of course short term we suffer: “Only cold spell coming, but not Winter,” says Heng.

Vote wisely. Remember: IMF affirms support for PAP policies.

Does this happen here, PJ Thum and friends?

In Malaysia on 15/05/2019 at 6:03 amFirdaus Abdillah, the editor of online magazine Neon Berapi, was arrested on Thursday night after allegedly badmouthing Johor Crown Prince Tunku Ismail Sultan Ibrahim in a series of tweets, reported local media.

Read more at https://www.channelnewsasia.com/news/asia/malaysia-mahathir-regrets-arrest-of-activist-crown-prince-11522290

When I read the above, I tot of

According to Kirsten Han, PJ Thum “urged (Mahathir) to take leadership in Southeast Asia for the promotion of democracy, human rights, freedom of expression and freedom of information”.

Kirsten Han trying to defecate herself and PJ out of self-made crater

Related posts:

Still urging Tun to take leadership in SE Asia; PJ, Kirsten?

WTF! With PAP on the ropes why this self-inflicted distraction?

Jolovan Wham: Nothing wrong in asking Tun M to intervene in S’porean affairs

If Tun still allows this to happen in M’sia, why should we want regime change here?

Vote wisely.

M’sia one yr on: What Tun’s fans here don’t tell us

In Malaysia on 14/05/2019 at 11:09 amWhen Tun and his new gang took power around this time last year, anti-PAP types were so happy. They asked him to bring democracy to S’pore:

— Kirsten Han trying to defecate herself and PJ out of self-made crater

— Jolovan Wham: Nothing wrong in asking Tun M to intervene in S’porean affairs

Well a year later, they kinda quiet and it’s not only because he threatened S’pore over water and territorial waters

— Let’s gloat at Tun as he threatens us

— Tan Kin Lian thinks Tun is more sinned against than sinning

The M’sian economy is in a bad place with foreign investors giving M’sia a miss. Deep divisions within the ruling coalition have prevented measures to increase government revenue, attract investment or create jobs. Poor Chinese died in a rush for food coupons: M’sian voters repenting?

Here’s what Reuters reports

Investor Concerns

Business sentiment has cooled after initial optimism that followed Pakatan’s electoral win, due mainly to a lack of consensus on the way forward for the economy, according to an April survey of 250 businesses by Ipsos Business Consulting.

“The continued lack of clarity on economic policies may lead to an increased level of anxiety among the businesses and further intensify the fear of an economic slowdown,” the firm said its report.

Investors in the survey also expressed concerns over currency fluctuations and slowing economic growth. The ringgit currency has slumped this year and stocks are underperforming regional rivals.

Malaysia has had to fill a revenue shortfall stemming from a populist measure to scrap a goods and services tax last year, while efforts to turn around struggling state entities that burden the treasury, including long-suffering Malaysia Airlines, have faltered.

In March, Malaysia’s central bank cut its 2019 economic growth forecast to 4.3-4.8% from 4.9%, on expectations of a significant drop in export expansion due to slowing global growth and the U.S.-China trade war.

On Tuesday, Bank Negara Malaysia became the first central bank in the region to cut its benchmark interest rate, in a move to support the country’s economy.

Mahathir has mended ties with China, reaching a cut-price $11 billion rail link deal, which is a welcome investment boost.

But with Malaysia’s debt-to-GDP ratio around 50%, public support waning and an unstable ruling coalition, it will become increasingly difficult for Mahathir to boost economic growth and win back disillusioned voters.

“With exports likely to remain in the doldrums, GDP growth in Malaysia looks set to slow to a post-financial crisis low this year. The government’s recent policies will make the downturn even worse,” Capital Economics said in a research note on Wednesday.

(Reuters)

Already the Malays are repenting for deserting UMNO

Support for the government fell to just 39% in March, sharply down from the 66% rating in August 2018, according to a survey by independent pollster Merdeka Center.

Mahathir also saw his popularity plunge to 46% from 71% over the same period, although he says he doesn’t put much faith in these numbers.

Worryingly for Mahathir, Merdeka Center said Malay Muslims, who make up around 60% of Malaysia’s 32 million people, were largely more critical of his administration.

Most of the poorest people in the country are Malay and for decades they have been the beneficiaries of subsidies and other affirmative action policies pushed by UMNO.

Many in the majority community were also angered when Mahathir appointed an ethnic Chinese finance minister and an attorney-general from the Malaysian-Indian minority, and said cash handouts to Malays could be reduced.

Pledges to end the death penalty and rescind oppressive laws such as the colonial-era Sedition Act were also unpopular with traditionalists.

Vote wisely.

HoHoHo: Bad news for Go-Jek and Grab

In Indonesia, Malaysia, Temasek, Vietnam on 11/05/2019 at 5:32 amUber’s shares sank almost 8 per cent below their offer price on Friday, giving the ride-hailing company a disappointing market value of below $70bn — a far cry from the $100bn valuation it had until recently hoped to achieve.

FT today

Meanwhile Lyft which was valued at U$22.4bn at its IPO closing price (up 9% from its offer price). By May 7th, the day it reported results for the first quarter as a public company, it was worth only US$17bn. Lyft’s share price fell by another 11% the next day.

These performances have

left investors questioning the appetite for unprofitable car-booking companies that have relied on a flood of private capital to fund heated expansion and competition.

FT

As Economist says

Both firms have enough cash to continue to burn money for years, but public investors expect a rapid path to profitability. Making it into the black will require either raising prices or reducing the cut of bookings passed on to drivers. The former will be hard; in many markets ride-hailing competes with other cheap modes of transport, such as buses, bicycles and riders’ own cars.

Think Grab and Go-Jek, and Temasek that has invested in them. Grab and Go-Jek are also losing money.

Btw, in 2018 according to an article in the Tiền Phong newspaper, GIC realised a 60% loss over 4 years after it sold 5.4 million shares in Vietnamese taxi operator Vinasun.

Jialat for M’sia and Indonesia/ Even a Chinese M’sian minister is stupid

In Indonesia, Malaysia on 05/05/2019 at 5:12 amA pair of Scottish entrepreneurs are aiming to go global with their hope to replace palm oil using coffee waste.

Scott Kennedy and Fergus Moore said they came up with a unique way to extract oil from used coffee grounds which had a wide range of uses.

Palm oil is found in many household products, but environmentalists say demand for it is devastating rainforests in Asia.

Manufacturers are now under pressure to find an alternative.

…

“About 60% of a cafe’s waste is about coffee grounds.

…

“The most exciting part for us is that they have all the same components as palm.

“Palm oil’s in the news for all the wrong reasons. It’s really exciting for us that we could potentially provide a local and more sustainable alternative to all the industries that are currently using palm oil.”

https://www.bbc.com/news/uk-scotland-scotland-business-48023412

In a sign of how nervous the M’sian govt is of criticism of palm oil, a M’sian minister criticises ‘sensationalised’ signs on palm oil at Singapore Zoo.

And she’s Chinese and from DAP. I tot only stupid, balls-carrying Malay ministers from Bersatu criticise S’pore. Didn’t realise got such people from DAP.

Will TOC ever report this about ringgit?

In Currencies, Malaysia on 19/04/2019 at 5:56 amBut to be fair, neither will any of the usual suspects in the anti-PAP alt media universe. Why? Because Tun is the Greatest and Regime change is always good?

Malaysian ringgit into Asia’s worst performer this month.

FTSE Russell said Monday it may drop Malaysian debt from the FTSE World Government Bond Index because of concern about market liquidity, roiling the nation’s currency and bonds. And less than two weeks ago, Norway said its sovereign wealth fund will cut emerging-market debt including Malaysian securities from its index.

Neither will they report

The Singapore dollar rose to a 17-month high against the Malaysian ringgit on Wednesday (Apr 17), as demand for the Malaysia currency weakened amid concerns the country’s debt may be removed from a key global bond index.

The Singapore dollar rose to an intraday high of RM3.0632 on Wednesday, the highest since the Singdollar touched RM3.0724 on Nov 20, 2017, according to global financial portal investing.com.

Year-to-date, the Singdollar has risen 0.74 per cent against the ringgit, according to Bloomberg.

Read more at https://www.channelnewsasia.com/news/business/singapore-dollar-rises-17-month-high-against-malaysian-ringgit-11456122

Will TOC dare report this about M’sia?

In Malaysia on 09/04/2019 at 10:46 amVoters, especially the young, are not happy with the new govt. They also think that economic prospects are as bad as when S’pore’s friend was in power.

Kajidata Research tracked the political leanings of 9,071 Malaysians aged 21 years old and above from before the 14th general election, and found that overall satisfaction for PH had slipped by 16.4 points in December, with the biggest fall seen in the 20-29 age bracket at 20.6 points.

It found that economic confidence had dropped of 6.5 points since GE14, and as of December 2018, the score was almost back to the level of when Barisan Nasional was in power.

“Though the decline in economic confidence was true for all age groups, the large drop within the youth bracket suggests that they may have become disillusioned with Pakatan Harapan’s management of the national economy,” Kajidata said in a report accompanying the study results.

https://www.todayonline.com/world/youth-support-pakatan-harapan-dips-economic-dissatisfaction-rises

Somehow, I doubt TOC and other anti-PAP alt media publications will dare report this because this report is evidence against their narrative “M’sia Yesterday, S’pore Tomorrow. Change is coming. and for the good.”

Vote wisely, vote tactically.

Want to die? Fly FlyFirefly?

In Airlines, Malaysia on 07/04/2019 at 10:14 amSingapore has withdrawn the Instrument Landing System (ILS) procedures for Seletar Airport while Malaysia has indefinitely suspended its permanent restricted area over Pasir Gudang, both countries said on Saturday (Apr 6).

Singapore’s Transport Minister Khaw Boon Wan and his Malaysian counterpart Anthony Loke said in a joint statement that the agreement was made “in the spirit of bilateral cooperation”.

…

“With this agreement, the Transport Ministers look forward to FlyFirefly Sdn Bhd’s commencement of flights to Seletar Airport effective April 2019,” they added.

Read more at https://www.channelnewsasia.com/news/singapore/singapore-seletar-airport-ils-malaysia-suspends-pasir-gudang-11418642

Wasn’t ILS introduced because FlyFirefly was going to use the airport? Will Tun or the M’sian transport minister say sorry when a FlyFirefly aircraft crashes, killing passengers and crew? M’sia objected to ILS after Tun and friends came into power.

M’sia getting “peanuts”; S’pore getting billions

In Casinos, Economy, Malaysia, Tourism on 05/04/2019 at 4:25 amIn M’sian casino operator kanna do NS by Tun?, I speculated that Genting M’sia was forced to buy a yacht by the M’sian govt for US$126m when others were bidding much lower prices.

Here’s the real reason why: Genting will spend S$4.5bn to improve the facilities on Sentosa and pay more tax here, all this when Tun is trying to bully and intimidate us. So maybe Genting was paying US$126m to keep him from getting upset that a M’sian company was going to spend billions here and not in M’sia?

How theS$4.5bn will be spent:

The new attractions of Super Nintendo World and Minion Park, spanning over 164,000 sqm, will be gradually rolled out at the Universal Studios Singapore every year from 2020 and completed around 2025.

Minion Park, inspired by the Despicable Me movie franchise, will take over the Madagascar zone, now designated for rides and shows tied to the animated movie of the same name. Both Minion Park and Super Nintendo World, based on Nintendo’s popular games and characters, will feature new rides and attractions.

The SEA Aquarium will also be expanded to take over the Maritime Experiential Museum, to create a new Singapore Oceanarium.

Apart from these, RWS’ waterfront promenade will be redeveloped to include a free public attraction featuring a nightly show and multi-purpose event zone that can be adapted for different festivals and events, as well as new dining options.

RWS will also introduce a driverless transport system across the Sentosa Boardwalk, which links to VivoCity mall in Harbourfront.

As for the increased taxes

a tiered structure for casino taxes will be introduced after the current moratorium ends in February 2022. Currently, there is a flat tax rate of 5 per cent for Gross Gaming Revenue (GGR) made through premium gaming and 15 per cent for GGR made through mass gaming.

Premium gaming refers to the GGR made through players who open a deposit account with a credit balance of no less than S$100,000. Mass gaming covers players who fall outside of this category.

With the change, the first S$2.4 billion of GGR from premium gaming will be taxed at 8 per cent, while GGR which exceeds S$2.4 billion will be taxed at 12 per cent.

For mass gaming, the first $3.1 billion of GGR will be taxed at 18 per cent while GGR which exceeds $3.1 billion will be taxed at 22 per cent.

In the context of all these goodies for S’pore, paying US$126 to M’sia is “peanuts”.

Btw the price of Genting S’pore (owned by controlling shareholder of Genting M’sia) fell: investors and analysts are not happy about the taxes, and capital expenditure that have spent.

M’sian casino operator kanna do NS by Tun?

In Malaysia on 04/04/2019 at 5:35 amM’sia’s government has sold a seized superyacht allegedly bought with money stolen from the 1MDB state fund for US$126m (£95.9m) the BBC reports. The buyer was Genting M’sia, the owner of the only legal casino M’sia.

Equanimity has been moored off the coast for the past five months, on show for potential buyers. The government said the pool of buyers was small, and while many offers were received, only a few topped US$100m. The price was short of the US$250m reportedly paid by Mr Low.

Wonder if Tun and his cabinet users will be regular users of the yacht as guests of Genting? Of course, all the rules will be followed. They don’t want to end up like Najib.

M’sians working here so poor meh?

In Malaysia on 31/03/2019 at 10:59 amOr juz cheapskate, law-breaking, entitled, lunch-stealing, freeloading criminals who think we scared of Tun?

Pasir Gudang MP Hassan Abdul Karim Hassan was quoted by The Star as telling reporters that S’pore should to discuss with M’sia, S’pore’s move to deny entry to those with outstanding fines for vehicle-related offences from April 1

He said this would cause “a lot of inconvenience” to the thousands of Malaysians travelling daily to Singapore for work.

He said the action reflects poor bilateral relations between the two govts. So why not tell Tun to stop trying to bully and intimidate S’pore on water supply and territorial waters?

Amount involved is S$32m according to the S’pore govt.

Related posts:

M’sian minister thinks M’sian drivers tua kee

Tun not happy with MayBank

In Banks, Malaysia on 20/03/2019 at 4:37 amNo not because it financed Tuaspring helping S’pore give him the finger over water.

But because Maybank (“May” is short form of “Malayan”) is saying that M’sians are buying our banks because they are of better quality, and pay higher dividends, thanks to the M$ being up s**t creek.

Maybank Kim Eng is keeping “positive” on Singapore’s banking sector while noting significant interest among Malaysian investors in Singapore banks from a flight-to-quality angle, and for their high dividend yields as the SGD appreciates.

This comes post a meeting with 15 Malaysian investors from a mix of long-only, hedge and private-banking funds to discuss Singapore banks and Maybank’s stock calls on them – for which the research house says was very little pushback on its top picks DBS and UOB, both rated “buy” with the respective target prices of $29.56 and $29.71.

OCBC, on the other hand, has a “hold” rating and price target of $10.73.

Note of all three banks, OCBC has the most exposure to M’sia because of its extensive branch network in Malaya and its life insurance biz via Great Eastern M’sia, 100% owned by Great Eastern.

Tun chickened out/ Two cheers for cowardly PAP govt

In Malaysia, Uncategorized on 15/03/2019 at 4:19 amM’sia and S’pore are to return to their respective port limits before M’sia’s initial extension on Oct. 25, 2018 of its port limits off Johor. In response, S’pore extended its port limits off Tuas on Dec. 6.

Seems M’sia has backed down as S’pore had proposed a return to the status quo before 25 Oct earlier this yr, but got the finger.

Whatever, two cheers* for the PAP govt. We got what we wanted without sinking a M’sian vessel as I and others suggested: Why sink a M’sian vessel.

Morocco Mole (Secret Squirrel’s trusted sidekick) tells me that his second cousin removed in the M’sian coast guard tells him that the “accidental” ramming of an intruding M’sian vessel by a Maersk vessel, has the M’sian govt really worried. What would they do if another such accident sank a M’sian ship? For starters, they don’t have the resources to do a search-and-rescue operation, and would have to beg S’pore for help. And they couldn’t recover their sunken vessel without our help.

Related posts

What Meng Seng and TOC don’t tell us about dispute with Tun

How to squeeze Tun’s balls real hard

*Note to cybernuts (in the event TRE uses this piece) who don’t know meaning of “two cheers” like “bapak” because they never went to an elite school or even lesser schools like Hwa Chong, only neighbourhood schools or vocational institutes: read https://www.macmillandictionary.com/dictionary/british/two-cheers-for

Why cybernuts are very happy this CNY

In Currencies, Malaysia on 10/02/2019 at 7:52 amSingapore dollar falls below RM3-mark for first time in 4 months

Read more at https://www.channelnewsasia.com/news/business/singapore-dollar-falls-malaysia-ringgit-currency-rm3-11222916

They are saying that S’pore is doomed under the PAP. They have been saying that since circa 1998 (the dawn of the internet age). Their predecessors have been saying that since 1959.

M’sian minister thinks M’sian drivers tua kee

In Malaysia on 05/02/2019 at 11:01 amThey have extraterritorial rights here isit? Like the ang mohs and Japanese in China at the turn of the 20th century? They could break Chinese laws and not face Chinese justice.

Taz what I tot When I read

Vehicles with unpaid fines banned from Singapore: Malaysia seeks further discussion, says minister*

Wah think can bully S’pore isit? Like trespassing our waters? Nk kum guan that cannot cancel HSR without compensation? And kanna pay us $15m in exchange for delaying HSR?

——————————————–

*More on M’sian arrogance:

Malaysia will hold further discussions with Singapore after the latter country announced a future ban on foreign vehicles with outstanding fines, said Malaysia’s Deputy Foreign Minister Marzuki Yahya on Sunday (Feb 3).

- “We understand the ban has been issued effective April 1, 2019. We are in the process of discussion with Singapore and we need to discuss further on the matter,” he told reporters after an event in the Penang town of Batu Kawan.

“We have our own method to discuss this matter with Singapore. The discussion will be conducted simultaneously with the bilateral meeting with the republic later,” he added.

Marzuki was speaking in response to Johor International Trade, Investment and Utility Committee chairman Jimmy Puah, who said on Saturday that Malaysia had the right to make the same rule.

Earlier on Saturday, Singapore authorities had announced that foreign vehicles with outstanding fines for traffic, parking or vehicular emissions offences may be denied entry from Apr 1.

They said that motorists of foreign vehicles have so far accumulated about 400,000 outstanding fines amounting to S$32 million.

Advertisement“About 60,000 foreign vehicles enter Singapore daily. The majority of foreign motorists are law abiding,” said the agencies that included the Singapore Police Force and Land Transport Authority.

Read more at https://www.channelnewsasia.com/news/asia/malaysia-further-discussion-singapore-foreign-vehicle-ban-fines-11199814

M’sian voters repenting?

In Malaysia on 30/01/2019 at 5:18 amBut first: M’sians become so poor meh?

Two elderly women in Malaysia have died in a crush caused by a crowd jostling to get free food coupons.

Only 200 coupons were available but more than 1,000 people showed up at an indoor market in the Pudu district in the capital, Kuala Lumpur, on Monday.

Btw, they both Chinese.

FT reports voters are repenting (OK, OK, sort of)

Malaysia: Our Malaysian political sentiment index plummeted almost nine points, bringing the cumulative drop since Mahathir Mohamad’s surprise election victory last year to more than 27 points. Mr Mahathir’s government has struggled to deliver on the sweeping reforms promised, while consumers are becoming increasingly aware of infighting within the cabinet. That said, our index remains above the 50-point mark separating improvement from deterioration, in contrast to the deteriorating sentiment recorded throughout the previous government under Najib Razak.

Vote wisely.

M’sian minister talking thru his ass

In Malaysia on 17/01/2019 at 11:39 amMomentum of Malaysia’s relationship with Singapore ‘very positive’: Economic Minister Azmin Ali

“A return of the Mahathir-Anwar leadership?” Really?

In Malaysia on 05/01/2019 at 1:23 pmNot if Anwar has learnt his lesson. The background

A return of the Mahathir-Anwar leadership?

Anwar Ibrahim enters 2019 in much the same position he was in some 20 years ago: in line to replace Mahathir Mohamad as prime minister of Malaysia.

The once close relationship between the two men turned sour in the late 1990s, during Mr Mahathir’s first stint as leader. The two clashed over the Asian financial crisis, and Mr Anwar was eventually jailed on sodomy charges that he says were fabricated for political reasons.

As part of an election-winning deal in 2018, however, Mr Mahathir has promised to hand over power to his one-time protégé “in a year or two.”

The focus now is on the two men’s relationship. One former minister recently proposed that they give the “1997 recipe” another try, with Mr Anwar becoming Mr Mahathir’s deputy ahead of the leadership handover.

Mr Anwar, however, seems to be playing his cards more carefully this time.

“I never push for [a succession deadline],” Mr Anwar told the Nikkei Asian Review in an interview in October.

But he also issued a warning to any would-be challengers.

“I have forgiven those who jailed, insulted and accused me,” Mr Anwar told party members in November. “I am nice and friendly with everyone, but don’t try to walk over me or I will take you on.”

CK Tan, Nikkei staff writer

His warning

“I am nice and friendly with everyone, but don’t try to walk over me or I will take you on.”

is directed at Azmin Ali, Malaysia’s economic affairs minister. Amin, his deputy in PKR also leads the anti-Anwar faction within the PKR.

It’s widely believed among people in the know in KL, that Tun is trying to get Azmin to depose Anwar so that Tun can say, “How to hand over power to Anwar, when his own party doesn’t want him?”. This is risky because if civil war breaks out in PKR, the coalition is at risk.

Whatever, Azmin and his gang

may slow, or add uncertainty to, Anwar’s accession to the premiership in the hope this buys Azmin time to position himself as Mahathir’s successor instead,” wrote Peter Mumford, Asia director at Eurasia Group, in a recent note. The rivalry could escalate if Mr Mahathir reshuffles Malaysia’s cabinet early this year and appoints Mr Azmin to a more powerful ministerial position. Wong Chen, a politician in Mr Anwar’s party, said many members of parliament were anxious about the political manoeuvring, but added: “The majority of us still believes the transition will happen where Anwar will assume the premiership at the end of 2019 or early 2020.”

FT

Tun’s greatest achievement and real Kiling unhappy

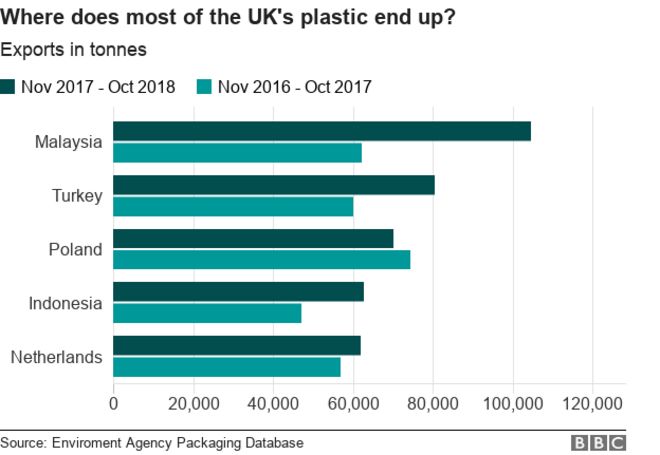

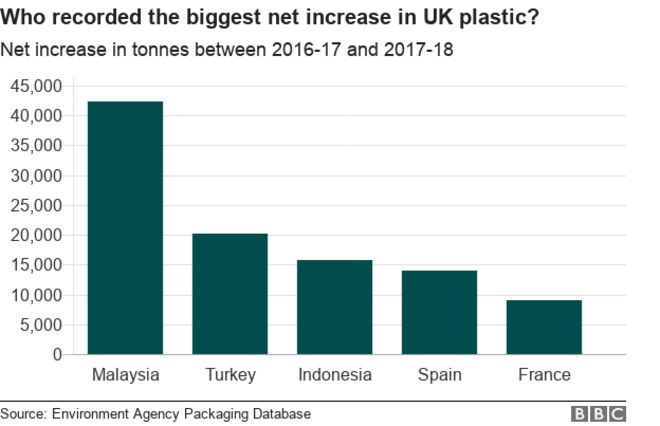

In Malaysia on 03/01/2019 at 10:01 amIn 2018, M’sia became the biggest importer of UK rubbish after China banned most rubbish imports from the rest of the world. M’sia boleh.

So will Kirsten Han and PJ Thum want other SE Asians countries to follow and be the dumping ground of the world’s rubbish? Still urging Tun to take leadership in SE Asia; PJ, Kirsten?

PJ and Ms Han should note that Kiling kay poh (another ang moh tua kee) not happy

Since China’s ban, Malaysia has seen a big surge in the amount of plastic it has received from abroad, including from the UK.

“Malaysia is not able to process all of the imported waste, there are limited plastic waste factories”, says Mageswari Sangaralingam who works for the Consumers’ Association of Penang and for Friends of the Earth, Malaysia.

According to Ms Sangaralingam, not only is Malaysia receiving more plastic than it can properly dispose of, some of it is low-grade which ends up as landfill. There are also some rogue recyclers who, she says, burn plastic in the open – leading to environmental harm.

The Malaysian government has announced stricter conditions on the import of plastic and says it wants to phase it out over the next three years – but Ms Sangaralingam wants an immediate outright ban.

“Malaysia is not a dumping ground and hence should stop importing plastic waste,” she says.

With enemy like Tun

In Malaysia on 29/12/2018 at 11:00 amPAP doesn’t need give away too many bribes goodies before next GE.

It can raise GST by 2% 2 points before GE and still win 70%. All it needs is Tun continuing to threaten S’pore. As I told one of Anwar’s pals and a former adviser of Tun, last week, with an enemy like Tun, the PAP doesn’t need to worry about winning 70% of the votes.

But then maybe, Tun has a secret Swiss bank account …

M’sia, S’pore are like …

In Malaysia on 22/12/2018 at 5:13 amSingapore and Malaysia are like two siblings, younger one graduated from university with a MBA and the older one from a special school and suffering from perpetual inferiority complex…but pretending that he is truly special….

FB post

So juz ram (and sink) that trespassing ship to show who is tua kee.

Still urging Tun to take leadership in SE Asia; PJ, Kirsten?

In Malaysia on 20/12/2018 at 10:31 amAccording to Kirsten Han, PJ Thum “urged (Mahathir) to take leadership in Southeast Asia for the promotion of democracy, human rights, freedom of expression and freedom of information”.

Kirsten Han trying to defecate herself and PJ out of self-made crater

Do they still believe that he’s the messiah SE Asia needs?

NHS rubber gloves made in Malaysian factories accused of forced labour

Exclusive: firms supplying health service allegedly exploit thousands of migrants

https://www.theguardian.com/uk/business

(Their favourite ang moh newspaper)

Champion for human rights ? What champion for human rights?

And does a champion for human rights do this?

in September, Dr Mahathir told the United Nations General Assembly that Malaysia would ratify all the human rights conventions it had yet to adopt, a total of six, including the measure against racial discrimination.

Then, Dr Mahathir had promised that Malaysia will espouse the principles promoted by the UN in its international engagements, saying: “It is within this context that the new government of Malaysia has pledged to ratify all remaining core UN instruments related to the protection of human rights.”

But he had added: “It will not be easy for us because Malaysia is multi-ethnic, multi-religious, multicultural and multilingual.”

Later in November, the Malaysian government backpedaled on its decision and chose not to ratify ICERD because it would require a two-thirds majority in parliament to amend the Federal Constitution.

“ICERD promotes freedom and less discrimination. Article 153 (of the Constitution) gives some privileges to the indigenous people, which means some may interpret it as being discriminatory,” Dr Mahathir had told the media. “If we tried to abolish these privileges, it will go against Article 153.”

The Pakatan Harapan government does not have a two-thirds majority in Parliament. Furthermore, several Pakatan Harapan MPs stated that they were not in favour of the ratification.

The proposed ratification of ICERD had also drawn criticism and protests from government and opposition representatives as well as NGOs.